Mortgage Data Validation

Check all the fields in all the loans all the time.

TRUSTED BY TOP 10 US BANKS

TRUSTED BY INNOVATIVE COMPANIES WORLDWIDE

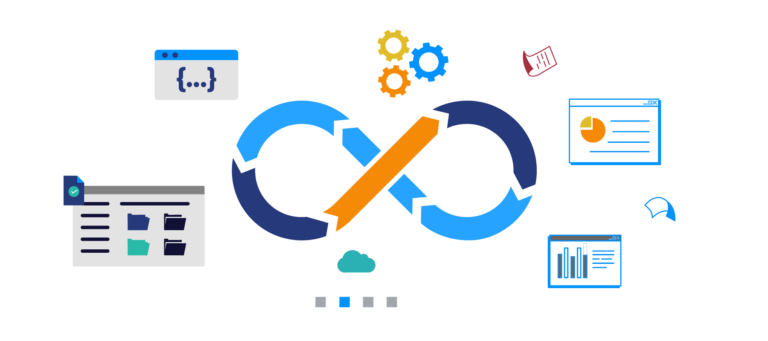

Accelerate your day-to-day

Lenders who originate loans kick off a decades-long lifecycle of processes, transactions, and approvals. Those transactions create massive amounts of information: spreadsheets and tables and endless paper trails. BaseCap keeps those files secure and accurate as the data moves through your systems.

As a mortgage loan is sold to and managed by servicers, files like credit reports and income statements travel with it. All that documentation can quickly become tangled or even go missing without proper data validation. BaseCap continuously verifies data from all your systems, giving you greater confidence in the loans you’re boarding and sending.

BaseCap enhances Mortgage Document Automation by streamlining the review process with our Doc2Data technology, ensuring accuracy across all documents.

Regulatory compliance can make or break a mortgage lender’s reputation. By uncovering areas of risk before they become an issue, BaseCap helps internal auditors protect their org from financial penalties and reputational damage while providing a clear paper trail for reporting to institutions like the FDIC and CFPB.

Trading and investing in Mortgage-Backed Securities (MBS) is vital to the liquidity of the mortgage industry. It’s also where unseen risk can have an outsized impact on the global economy. Lenders use BaseCap to gain greater transparency of their loan information, helping them overcome many of the challenges that precipitated the 2008 financial crisis.

Lenders, servicers, sub-servicers, and other mortgage entities must regularly report critical financial and operational data to boards and investors. This communication is critical for maintaining transparency and trust and is often compulsory by legal and regulatory obligations. BaseCap accelerates the compilation of these reports and ensures 100% accuracy of the underlying intel.

Loan Due Diligence Certifications

Certify loan portfolios for common due diligence checks before the purchase.

Take back time and resources

Lenders and servicers use BaseCap to automatically validate 100% of loan documents.

Servicing Transfer

Servicing Transfer

Document Data Review

Document Data Review

Checklist Automation

Checklist Automation

SCRA Compliance Automation

SCRA Compliance Automation

Post-Close Quality Check

Post-Close Quality Check

CCAR Reporting

CCAR Reporting

Explore the future of mortgage jobs

Learn how AI will enhance the daily workflows of mortgage professionals. Then, take the best first step in AI adoption: total data validation.

Minor shift, major reward

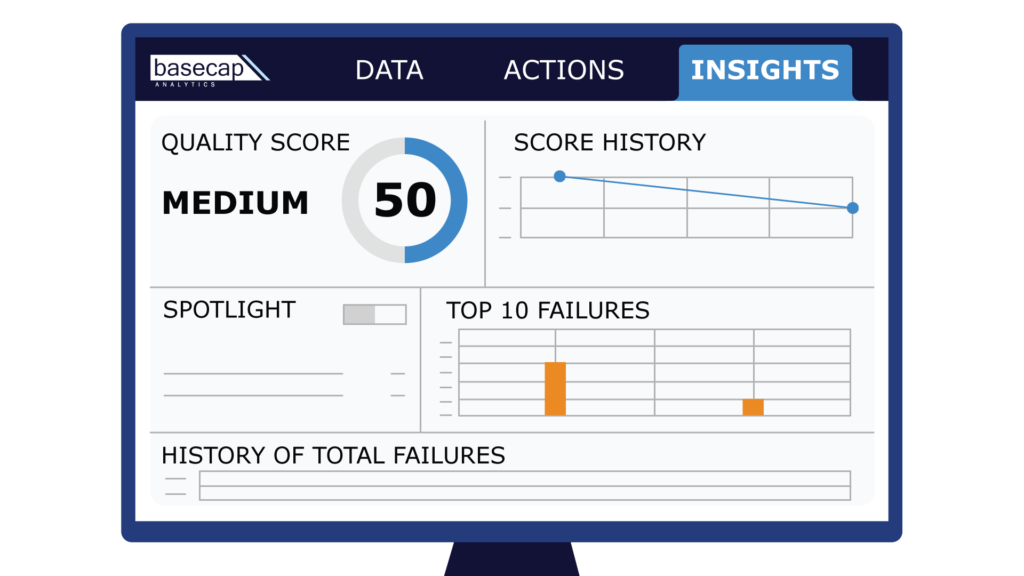

Get rid of customer complaints, hidden risk, and regulatory fines by taking a new approach to loan validation. A simple integration with BaseCap connects and verifies all the files and spreadsheets your business runs on.

The BaseCap difference

Financial institutions have used our Platform to:

- Scan 28 million data fields per week

- Run 2,300+ policies per week

- Save 1,000 hours of manual work per week

- Achieve a 3X return on investment

What our users think

Ready to see BaseCap in action?

Meet with one of our data quality experts to discover how our platform can address your data challenges.