Use Case

Compliance Management

Eliminate risk, provide proof of compliance, and maintain a strong reputation among consumers and regulatory bodies.

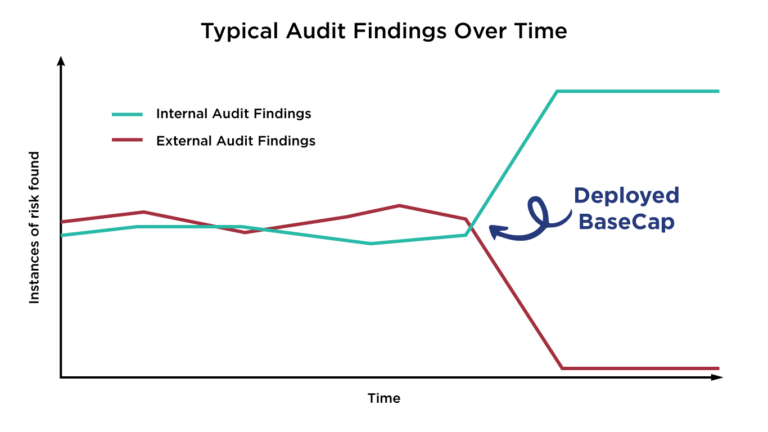

Faster Internal Audits

When you use BaseCap to validate your data for compliance management, you can identify more risk, faster. By proactively managing these findings, you’ll reduce scrutiny by external regulators.

Are you facing these challenges?

To pull hidden risk out of the shadows, you need an operation that connects, standardizes, and illuminates ALL your data.

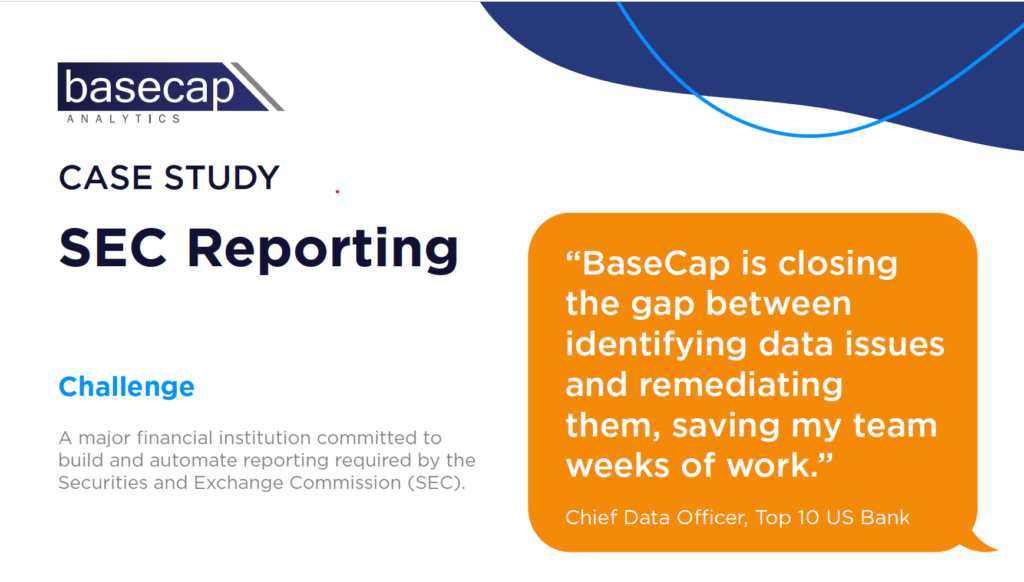

Take it from our clients.

Explore how one mortgage company used BaseCap to streamline their reporting to the SEC.

How confident are you in proving compliance?

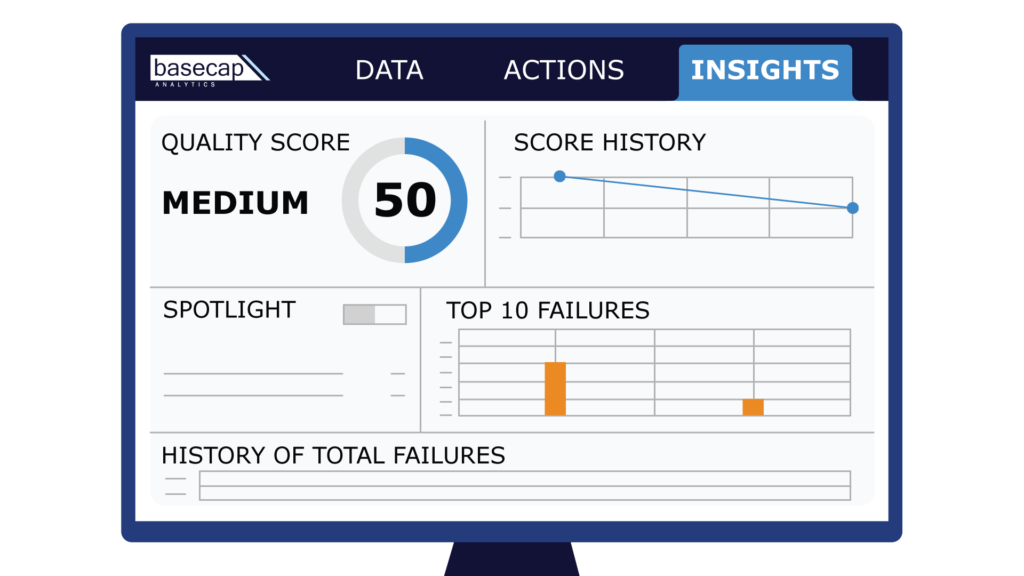

It's not enough to find risk before it bites you. Heavily-regulated orgs need a paper trail to prove to external auditors that they've met strict guidelines.In BaseCap, the paper trail extends across all your data, not just a sample, so you can sleep easy knowing you’ve discovered and documented hidden risk.

“A BaseCap client was able to reduce the amount of people and touchpoints required for an internal audit to one, greatly streamlining their processes and allowing for better resource allocation.“

~ Jason Ahl, Head of Mortgage Solutions

Ready to see BaseCap in action?

Meet with one of our data quality experts to discover how our platform can address your data challenges.