Certify Whole Loan Portfolios

Receive a third-party review and certification of loan due diligence before purchasing or selling portfolios.

Perform Due Diligence in 24 Hours*

BaseCap is a tech-enabled due diligence solution used to certify portfolios with greater accuracy and consistency in one business day.

Due diligence professionals are 83% more productive with BaseCap.

0

%

4 Steps to Rapid Diligence

1. Choose Your Loan Product

- Residential Mortgages

- Commercial Mortgages

- Home Equity Lines of Credit

- Buy Now Pay Later Loans

- Time Share Loans

- Auto Loans

- Corporate Loans

- Student Loans

- Personal Lines of Credit

- Residential Transition Loan

- Equipment Financing / Leasing

- Peer to Peer Loans

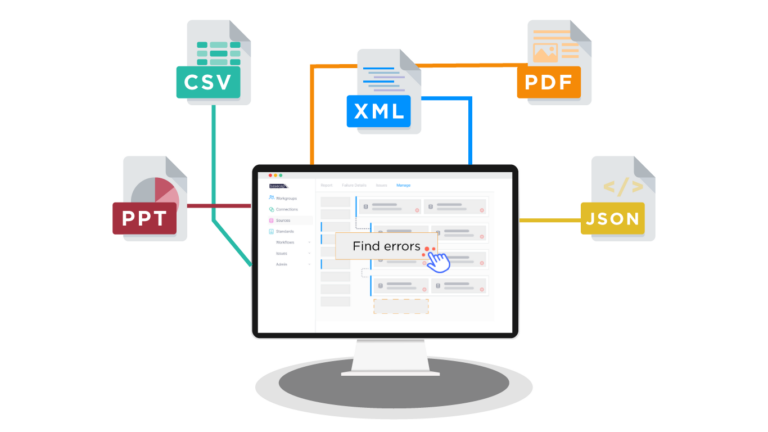

2. Select Your Diligence Checks

How do you want to validate your data?

Asset Fact Review

Policy Packs:

- Critical Documents

- Cross-Document Consistency

- Document to Data Source

- Data Validation

Collateral Performance

Policy Packs:

- Title & Lien Position

- Underwriting Guidelines

- Appraisal & Valuation

Credit & Compliance

Policy Packs:

- Income Validation

- Credit Score & History

- Underwriting Guidelines

Fraud Detection

Policy Packs:

- Government Document Verification

- Cross-document consistency Checks

- Document to 3rd Party Data Source Checks**

**Requires 3rd party background check source data

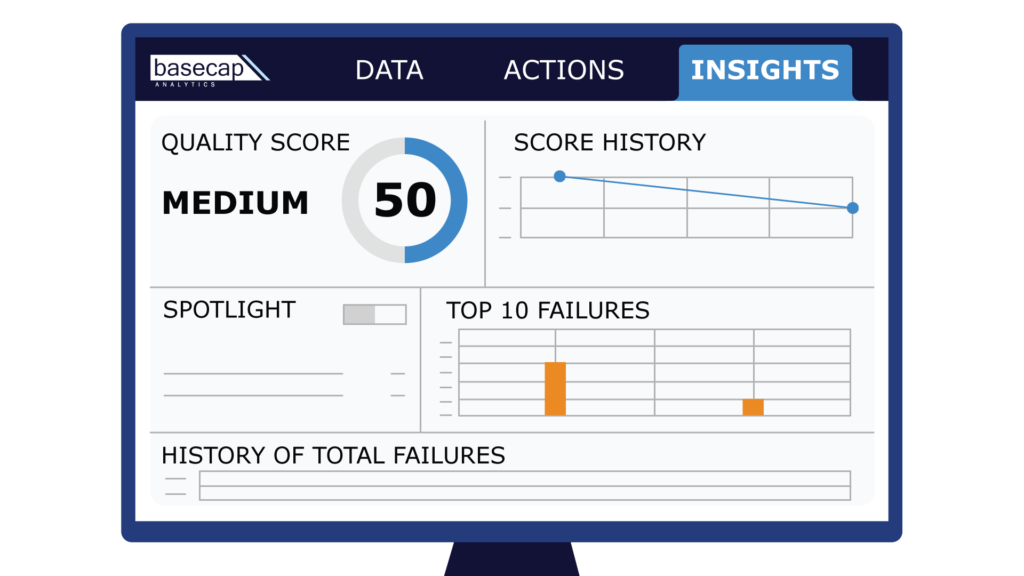

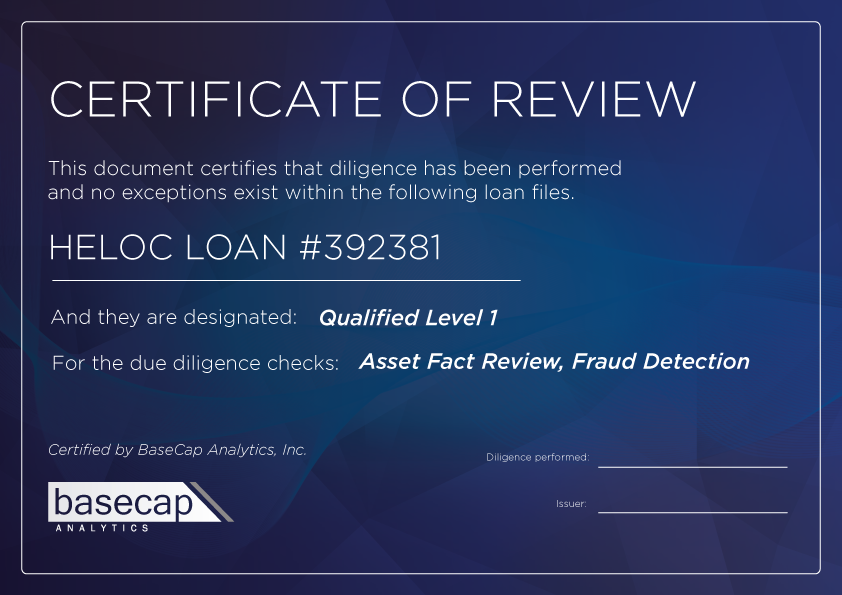

3. Certify Your Loan Data

Based on the results of your automated due diligence check, your files will receive a certification level, a full report of exceptions, and third-party supplemental reports.

Quality Designations:

- Qualified Level 1: No exceptions exist within the loan or loan files. The loan conforms to the agreed-upon policies.

- Qualified Level 2: The acceptable permitted policy guidelines were met. Exception validations are documented and do not introduce material risk.

- Unqualified: No certificate or badge is issued; critical and high-risk exceptions were identified and unresolved, indicating significant potential risk.

The BaseCap difference

Financial institutions have used our platform to:

- Scan 28 million data fields per week

- Run 2,300+ policies per week

- Save 1,000 hours of manual work per week

- Achieve a 3X return on investment

Ready to see BaseCap in action?

Meet with one of our data quality experts to discover how our platform can address your data challenges.