Streamline Loan Quality Assurance with Automated QA Solutions

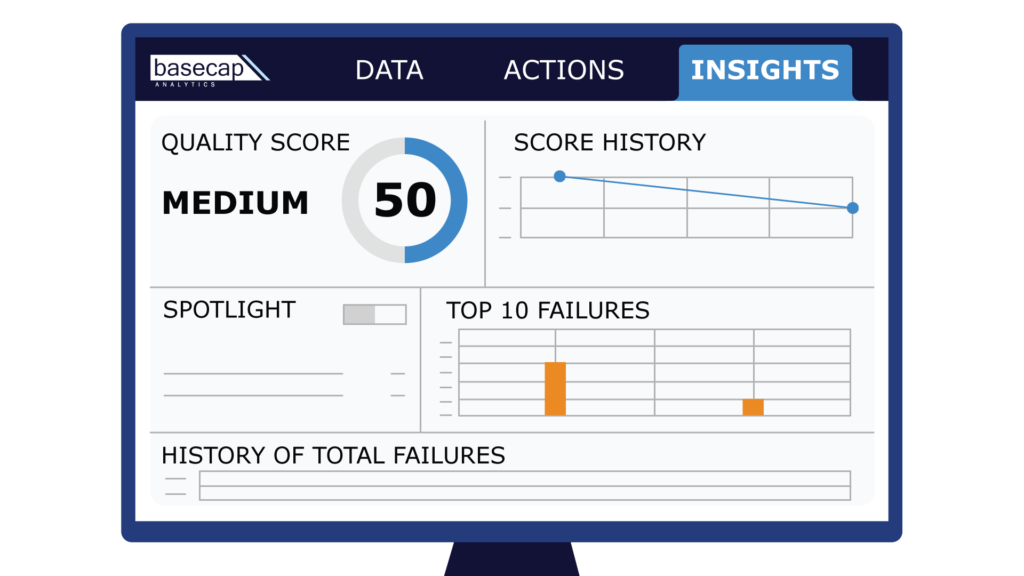

Total visibility and control of financial data

TRUSTED BY TOP 10 US BANKS

TRUSTED BY INNOVATIVE COMPANIES WORLDWIDE

Accelerate your day-to-day

Banking relies heavily on accurate and reliable data to ensure smooth transactions and maintain trust among stakeholders. Robust data health is crucial for preventing financial losses, identity theft, and fraud, while also safeguarding the reputation of banks. With the increasing complexity of digital banking, investing in better data management and security measures is essential for the industry’s resilience and sustainability.

Asset management firms rely on precise data to optimize investment strategies, allocate resources efficiently, and deliver superior returns to investors. Inaccurate or incomplete data can lead to suboptimal investment decisions, increased risks, and diminished performance. Prioritizing better data health enables asset management firms to enhance decision-making, minimize risks, and ultimately deliver more value to their clients and stakeholders.

Fintech companies leverage data as the cornerstone of their innovative solutions, shaping the future of financial services. Ensuring robust data health is crucial for these companies to maintain regulatory compliance, safeguard customer privacy, and build trust in their platforms. By prioritizing better data health practices, fintech companies can foster customer confidence, drive growth, and stay competitive in the rapidly evolving financial technology landscape.

Hedge funds and private equity companies heavily rely on accurate and comprehensive data to identify investment opportunities, assess risks, and optimize returns for their clients. Poor data health can lead to flawed analysis, misinformed decisions, and potential financial losses, undermining their competitiveness and credibility. By prioritizing better data health measures, these firms can enhance their investment strategies, minimize risks, and ultimately deliver superior results to their investors.

Payment processors play a critical role in facilitating secure and efficient transactions across various industries. Maintaining robust data health is essential for these companies to safeguard sensitive financial information, prevent fraudulent activities, and ensure compliance with regulatory standards. By investing in better data health practices, payment processors can enhance trust among merchants and consumers, strengthen their market position, and sustain long-term growth in the rapidly evolving payment ecosystem.

Servicers, tasked with managing loans, mortgages, and other financial assets, rely on accurate and reliable data to effectively carry out their responsibilities. Poor data health can lead to errors in loan servicing, compliance issues, and legal liabilities, ultimately eroding trust and reputation. By prioritizing better data health practices, servicers can enhance operational efficiency, mitigate risks, and ensure positive outcomes for both borrowers and investors.

Accounting firms serve as custodians of financial data, providing critical insights and assurance to stakeholders. Improved data health within accounting firms is essential to ensure the accuracy and integrity of financial reporting, preventing errors, discrepancies, and potential regulatory violations. By prioritizing better data health practices, accounting firms can enhance the reliability of their services, bolster client trust, and uphold the integrity of the financial ecosystem.

Take back time and resources

Lenders and servicers use BaseCap to automatically validate 100% of loan documents.

System Reconciliation

System Reconciliation

Document Data Review

Document Data Review

Checklist Automation

Checklist Automation

Cash Remittance Validation

Cash Remittance Validation

Compliance Management

Compliance Management

CCAR Reporting

CCAR Reporting

Explore the future of mortgage jobs

Learn how AI will enhance the daily workflows of mortgage professionals. Then, take the best first step in AI adoption: total data validation.

Minor shift, major reward

Get rid of customer complaints, hidden risk, and regulatory fines by taking a new approach to loan validation. A simple integration with BaseCap connects and verifies all the files and spreadsheets your business runs on.

The BaseCap difference

Financial institutions have used our Platform to:

- Scan 28 million data fields per week

- Run 2,300+ policies per week

- Save 1,000 hours of manual work per week

- Achieve a 3X return on investment

What our users think

Ready to see BaseCap in action?

Meet with one of our data quality experts to discover how our platform can address your data challenges.