Use Case

System Reconciliation

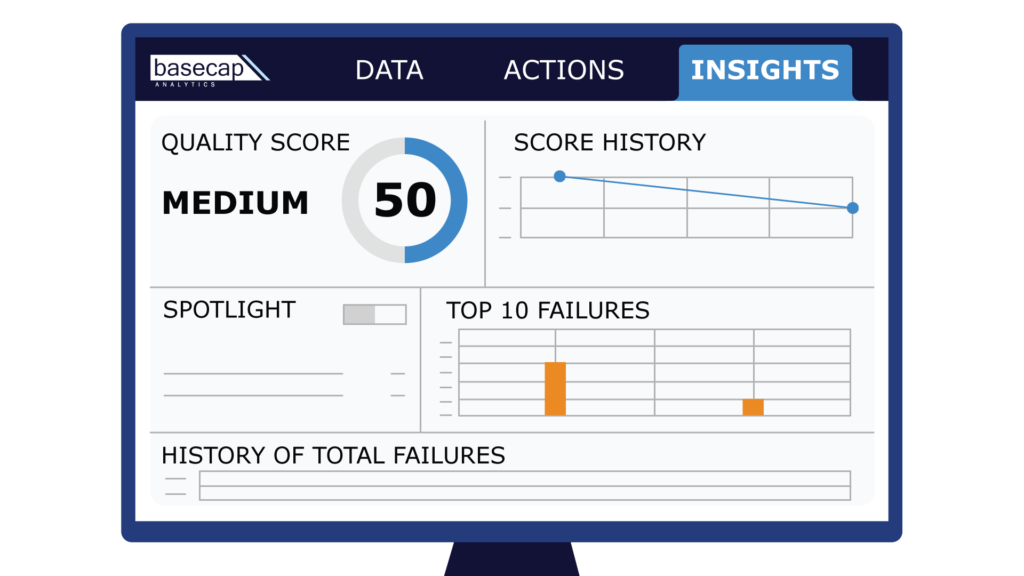

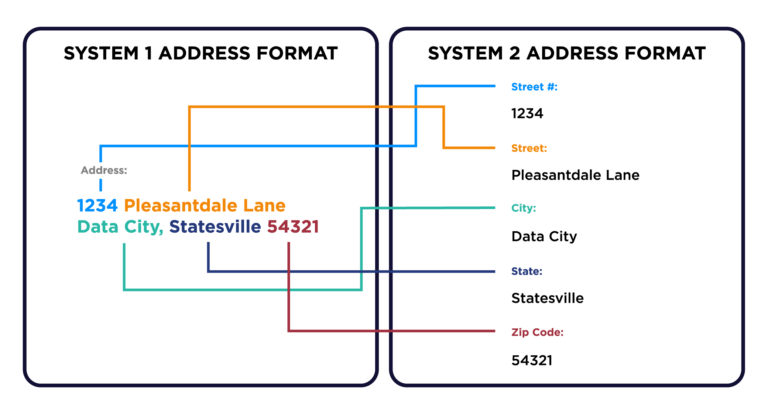

Operations teams rely on their data systems communicating with each other to produce insight about the business. But even data sets from the same system can speak different languages.

Merge and Standardize Data Tables

From address formats and date fields to financial forecasts and CRMs, BaseCap helps systems with different codes and nomenclatures speak to each other.

Are you facing these challenges?

Sending large data sets between partners, customers, and internal departments can often lead to communication breakdown. BaseCap acts like a universal translator that reconciles unique definitions, column types, and file formats between systems.

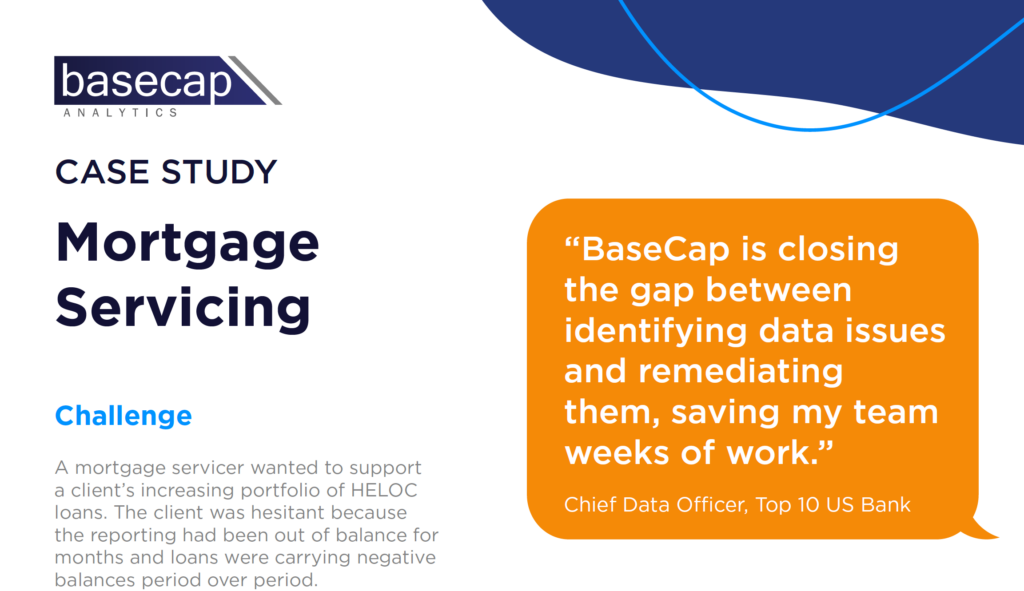

Take it from our clients.

Explore how one mortgage servicer supported an increasing portfolio of HELOC loans with BaseCap data standardization.

"Roger that."

Do your data systems have a communication problem? All the software and databases and CRMs and file shares that your business runs on can't create insight if they speak different languages. “We’ve seen two companies that use the exact same program to board and transfer loans, and still – none of the fields and definitions line up.”

~ Craig Riddell, Executive Director of Sales and Account Management

Ready to see BaseCap in action?

Meet with one of our data quality experts to discover how our platform can address your data challenges.