NEWS

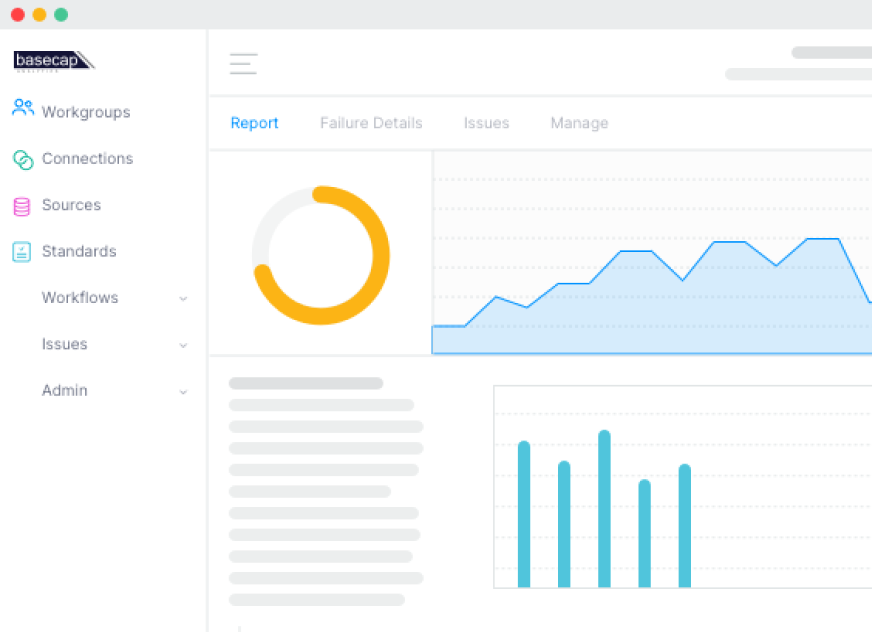

BaseCap Analytics Honored With HousingWire Tech100 Mortgage Award

2.3.25

For the past 13 years, the Tech100 program has provided housing professionals with a definitive list of the most forward-thinking organizations in the mortgage industry.

Read Article