Use Case

Servicer Transfer

Board and transfer large volumes of loan data in minutes with 100% accuracy.

TRUSTED BY TOP 10 US BANKS

TRUSTED BY INNOVATIVE COMPANIES WORLDWIDE

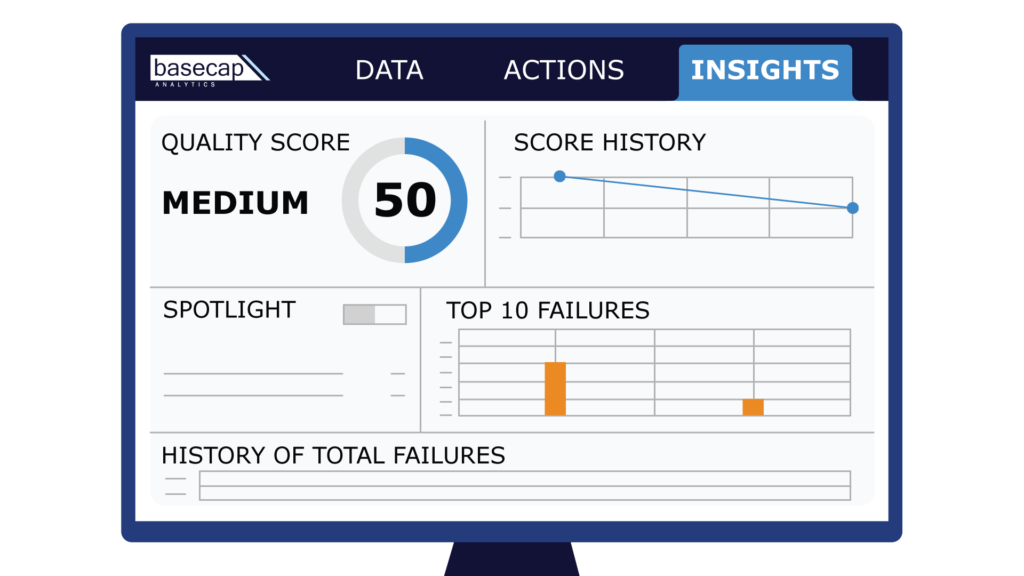

Faster, More Accurate Servicing Transfers

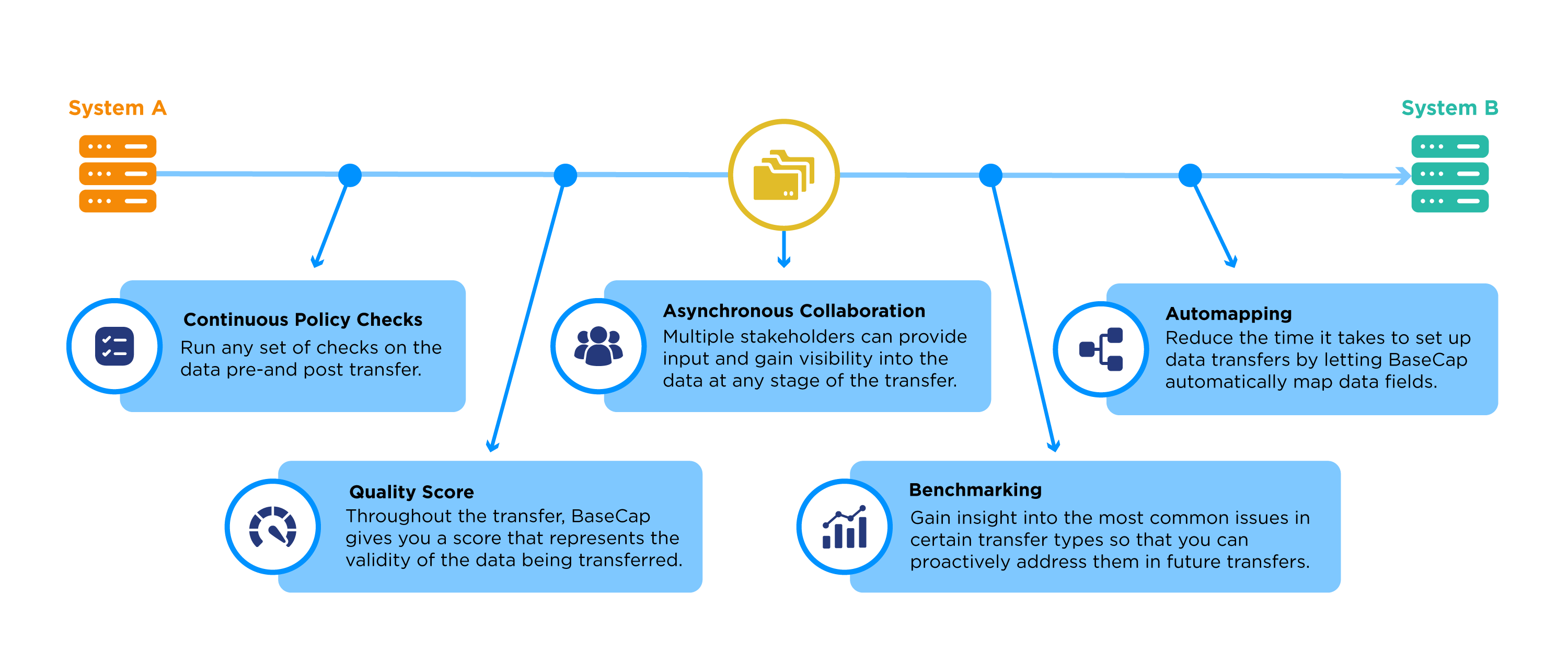

When moving large volumes of data from one system to another, BaseCap applies a number of innovative features to help increase the speed and accuracy of your transfer.

Are you facing these challenges?

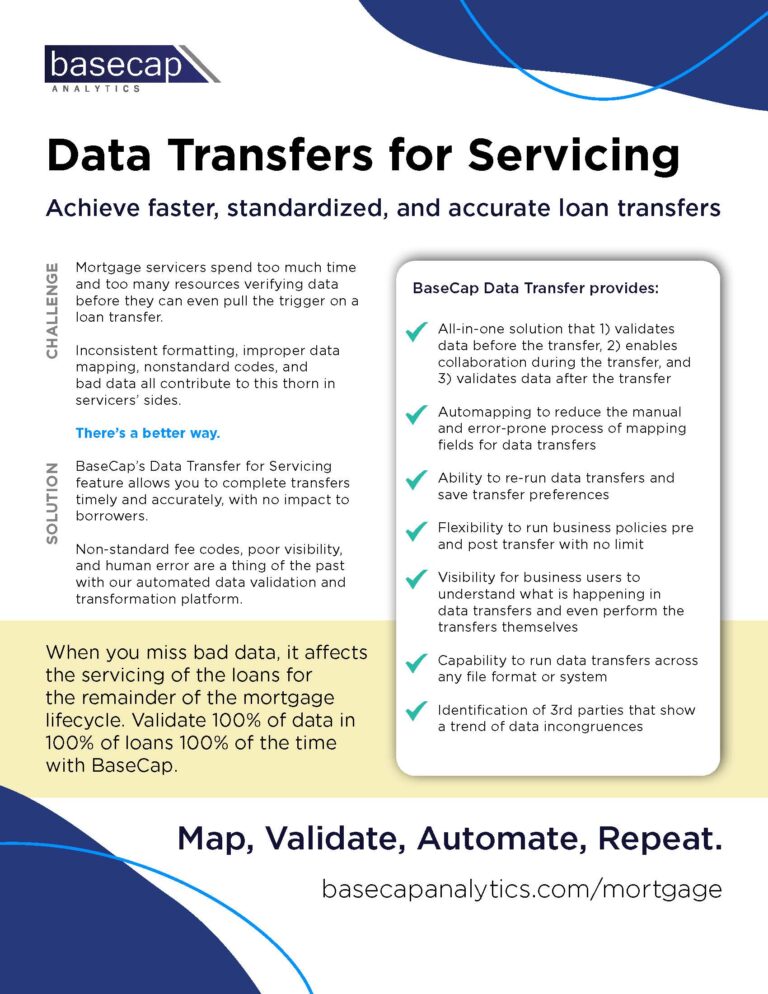

With the ability to automap data fields, continuously validate 100% of data, and benchmark transfers of similar types, BaseCap can reduce the length of a servicer transfer from months to weeks, or even days!

Explore our Demo Tracks

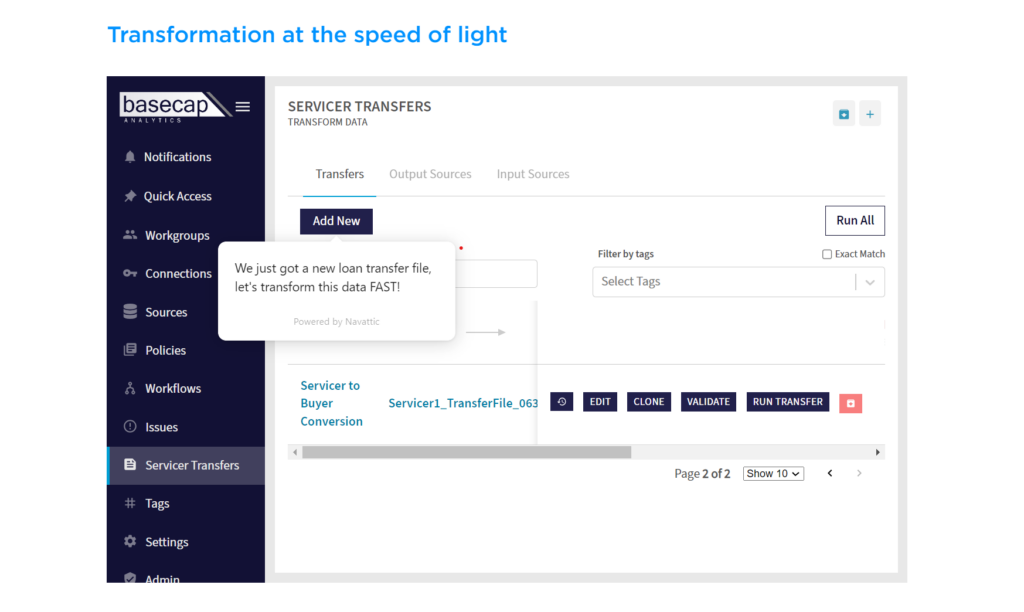

Try BaseCap’s data transfer tool in action. Visit our demo page to find out how you can set up a transfer in seconds.

How long do your routine servicer transfers take?

Download our solution sheet to learn how BaseCap makes servicing transfers faster and more accurate. “A tremendous amount of the data transfer process between servicers can be automated by BaseCap. The platform can identify where there is similarity between data sets, automatically marry them, and decode them so that you board accurate data.”

~ Jason Ahl, Head of Mortgage Solutions

Ready to see BaseCap in action?

Meet with one of our data quality experts to discover how our platform can address your data challenges.