Interactive Demo Tracks

Automated Mortgage Solutions

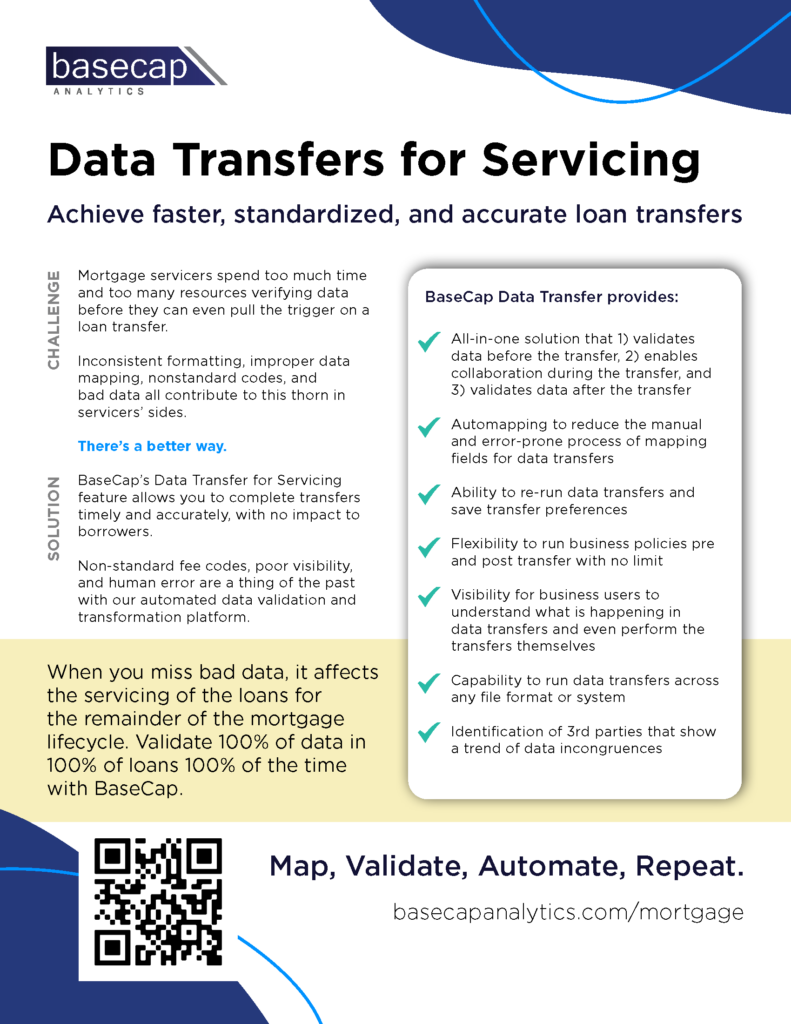

Explore our platform to discover how you can achieve faster, standardized, and accurate loan transfers.

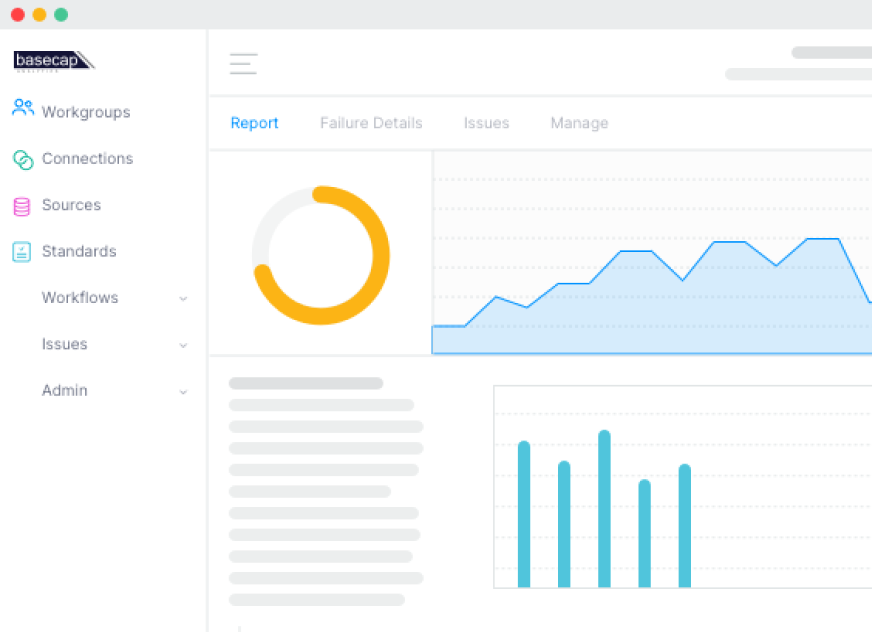

Try out our servicing transfer capabilities

Experience BaseCap's rapid data transfer workflow, featuring automapping, data validation, and real automation.

Transformation at the speed of light

Loan boarding validation

What else can you do with BaseCap?

These are some of the most common challenges that BaseCap is solving for our customers.

You name it; we can transform it, validate it, and automate it.

Service Transfer Automation

BaseCap Solution

- Loan boarding has historically been a challenging process. Even the smallest transfers require many reviews, reconciliations, and trials in which loans with issues still slip through the cracks. With Servicing Transfer Manager, you can automate the transfer process and confirm the data you are ingesting is accurate, preventing customer impact and downstream risk with an expedited, end-to-end experience. This means formatting issues are swiftly identified with inaccurate, illogical, and/or non-compliant data, and variances between collateral documents and loan boarding details are easily identified.

Non-Performing Loan Review

BaseCap Solution

- Recoup potential losses from prior servicers by leveraging Quality Manager to automatically conduct a post-boarding evaluation of timelines and advances on non-performing loans to identify overallowables and areas of risk.

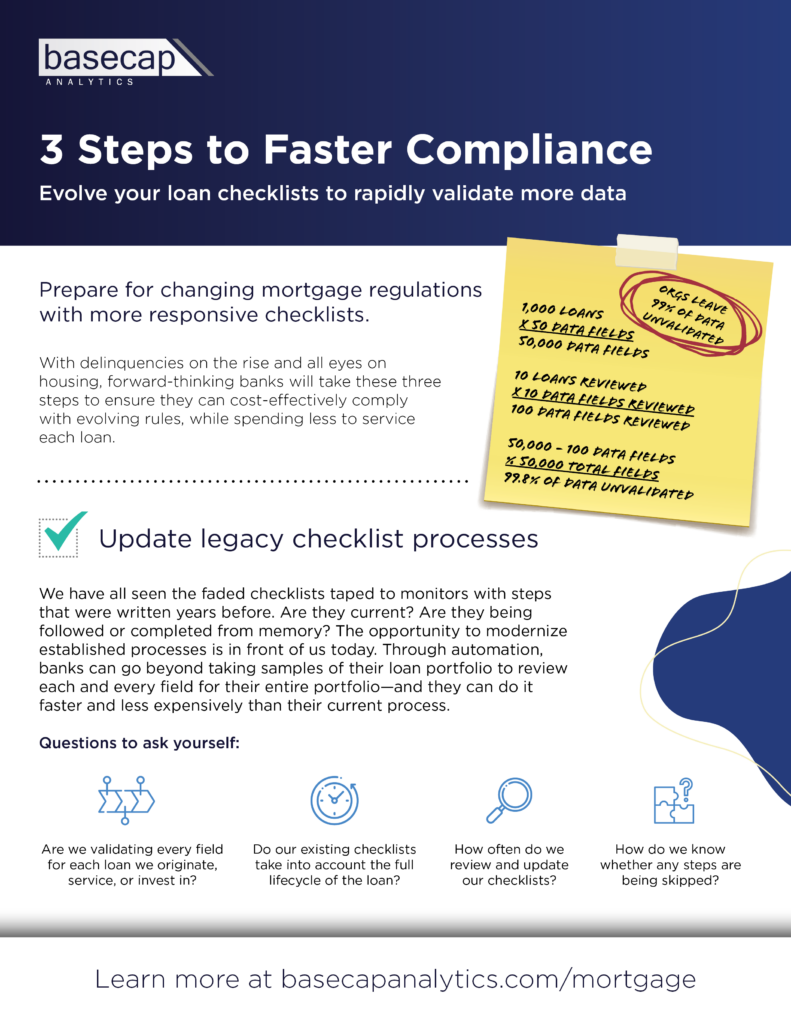

Checklist Automation

BaseCap Solution

- Expedite daily processes by eliminating the manual completion of checklists. Checklists are leveraged daily throughout the loan lifecycle to confirm completeness and compliance. While many checklists are now digitized, there remains a requirement for team members to evaluate the system of record and insert a response for most checklist items. Quality Manager removes the human touch from checklist completion by evaluating and comparing multiple data sets against client-defined policies to ensure completeness, accuracy, and compliance.

System-To-System Recon

BaseCap Solution

- Automatically perform comparative data analysis within multiple applications to ensure accurate reporting for your operators, executives, and regulators. Quality Manager automatically maps similar data elements between systems and recommends validation testing to quickly identify anomalies and mismatches.

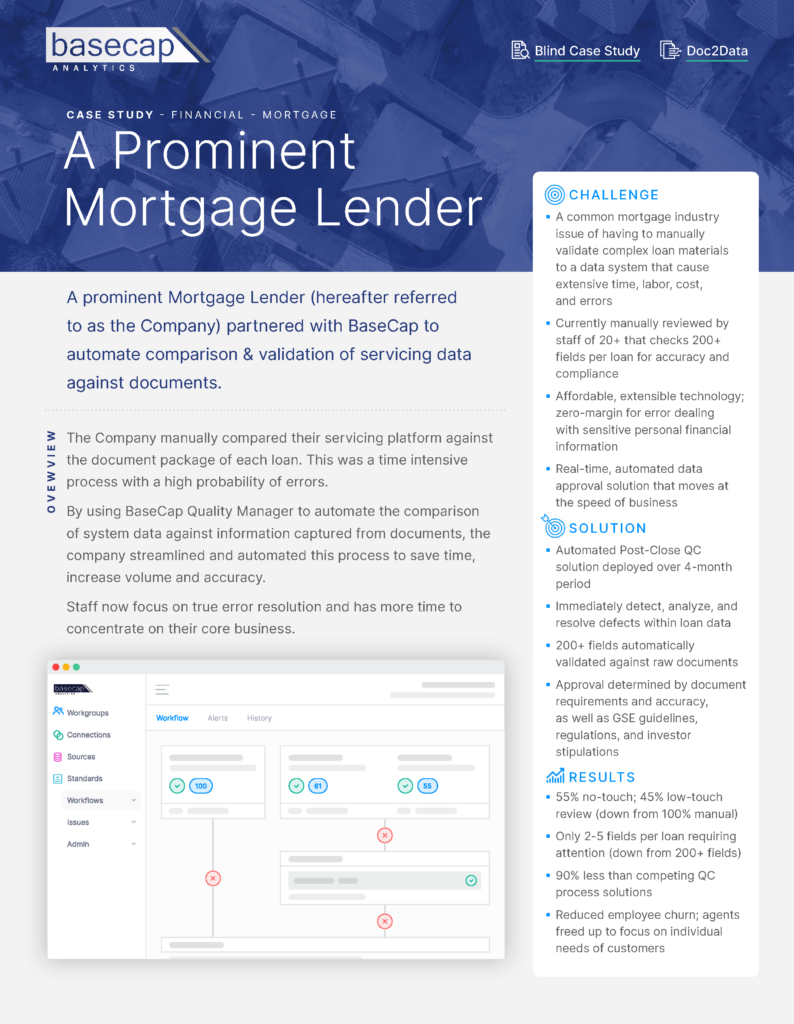

Doc-To-Data Validation

BaseCap Solution

- Confirm loan details match pertinent documents in any and all of your business applications. Most commonly used for pre-funding and post-closing QC.

SCRA Automation

BaseCap Solution

- The current process for SCRA compliance validation can be painful, splintered, and incomplete. Many organizations don’t have a scalable solution and only review a small percentage of their loans, inviting risk and increased scrutiny. With our SCRA solution, BaseCap can provide multiple levels of automation that include validating active-duty details are appropriately reflected in your servicing platform, coordinating with impacted teams, and ensuring compliance daily. BaseCap’s automation allows employees to focus on actionable exceptions with a scalable solution that has no limits to volume or frequency, including newly boarded loans.

More Resources

Ready to see the full demo?

Let us show you how the BaseCap platform can help solve your mortgage challenges.