Intelligent Document Processing

Automatically scan, validate, and index key business documents

TRUSTED BY TOP 10 US BANKS

Accelerate QA With Document Capture

Enhance OCR

BaseCap makes document capture more accurate with a customizable validation layer.

Unlock Financial Data

Automate the extraction and validation of data in 1040s, 1098s, and other critical financial docs.

Compare to Golden Source

Standardize and compare new document data to your system of record.

Our OCR Partners

Azure Form Recognizer

Preferred partner for self-service document capture.

Financial Doc Recognition

Preferred partner for advanced mortgage document extraction.

Your OCR Solution

Ask us about integrating with your existing OCR provider.

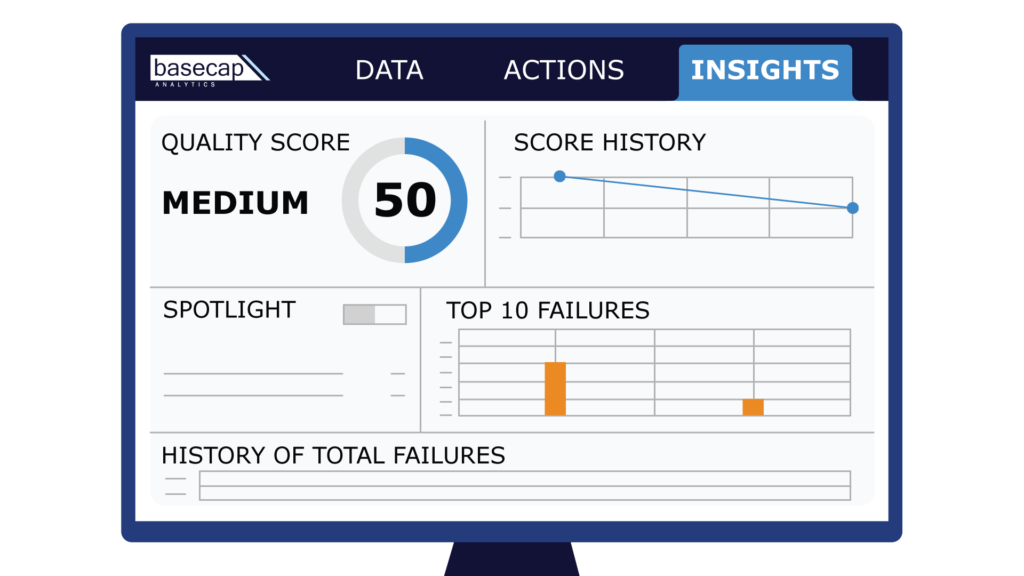

The BaseCap difference

Financial institutions have used our platform to:

- Scan 28 million data fields per week

- Run 2,300+ policies per week

- Save 1,000 hours of manual work per week

- Achieve a 3X return on investment

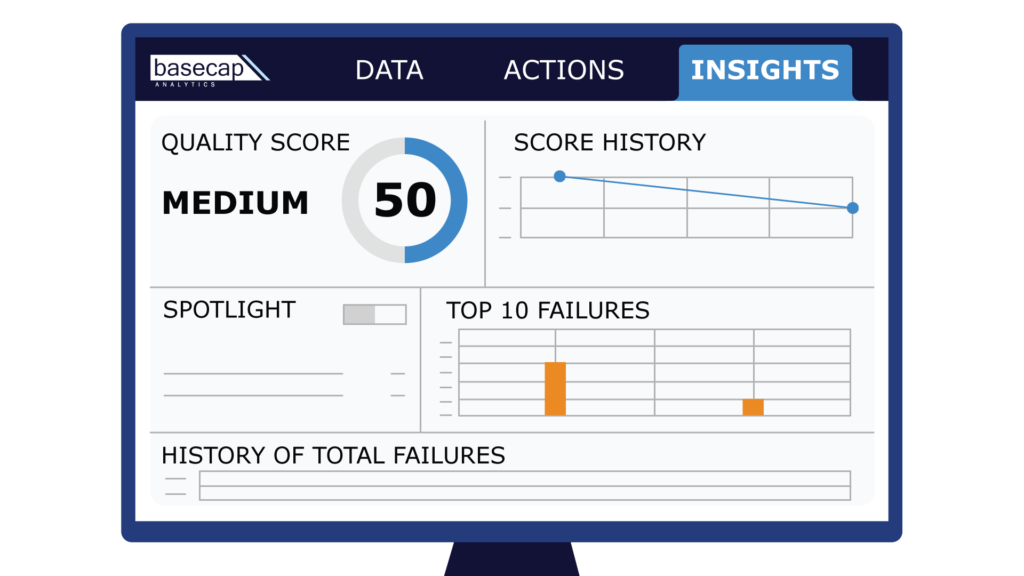

Intuitive Data Validation

In one no-code platform, your teams can:

- Standardize data from different files

- Create policies to validate data

- Run unlimited checks across all data fields

- Alert personnel to fix identified issues

Data Validation Resources

Optical Character Recognition

The ability to extract data from documents has forever changed how businesses ingest, track, and validate critical information. Before Optical Character Recognition (OCR) Before the digital age, data was entirely collected on physical formats such as an application form or an invoice. To compare this data to other sources of information, like an excel spreadsheet, […]

The Impact of Bad Data

The Increasing Dependence on Data Organizations across industries are becoming more “data-driven.” The mortgage industry for example, faces downward margin pressures and immense competition from a surge of fintech upstarts. Some are turning to Artificial Intelligence/Machine Learning (AI/ML) models to identify new opportunities, such as launching campaigns for clients who may want to refinance their mortgages. […]

Avoid Data Errors Amidst Record Breaking Origination Volume

Data technology sets the stage for organizations to identify issues before they become more costly down the line

Changes to the Regulatory Environment: Dodd-Frank Rollbacks

On May 22nd, 2018, Congress approved the first major Dodd-Frank rollback to relax federal oversight for banks with less than $250 billion in assets. This revision brings the number of banks categorized as systemically important (SIFI) and subject to stricter federal oversight from 38 to be 10 or less. This change frees many mid-sized banks […]

FDIC Insurance Premiums and Basel III

The Federal Deposit Insurance Corp introduced a series of proposals this week aiming to align new Basel capital standards for banks and FDIC insurance assessments. The proposals would revise the way the FDIC calculates payments required for the agency fund designed to protect depositors against bank failures. The FDIC takes into account institutions’ capital levels […]

The Future of Mortgage Loan Servicing

Tomorrow’s Servicing: Automated Transfers, Recoverables and Accuracy: In this webinar, you will hear industry veterans from mortgage giants...

Ready to see BaseCap in action?

Meet with one of our data quality experts to discover how our platform can address your data challenges.