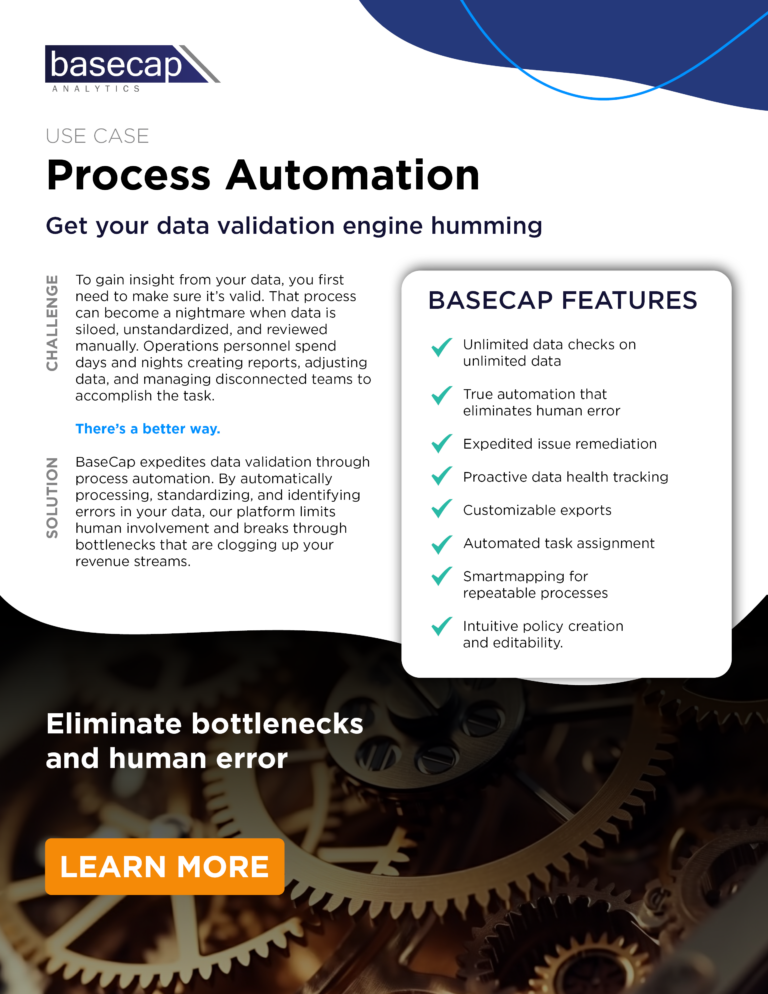

Use Case

Process Automation

There are thousands of processes that keep your company’s engine humming.

But a chink in the gears can quickly slow down business.

What's slowing down your processes?

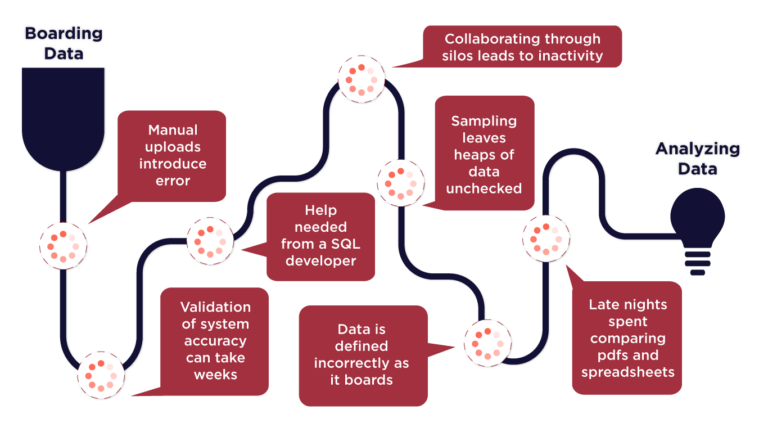

In the lifecycle of your most important data, there are many opportunities for corruption.

Are you facing these challenges?

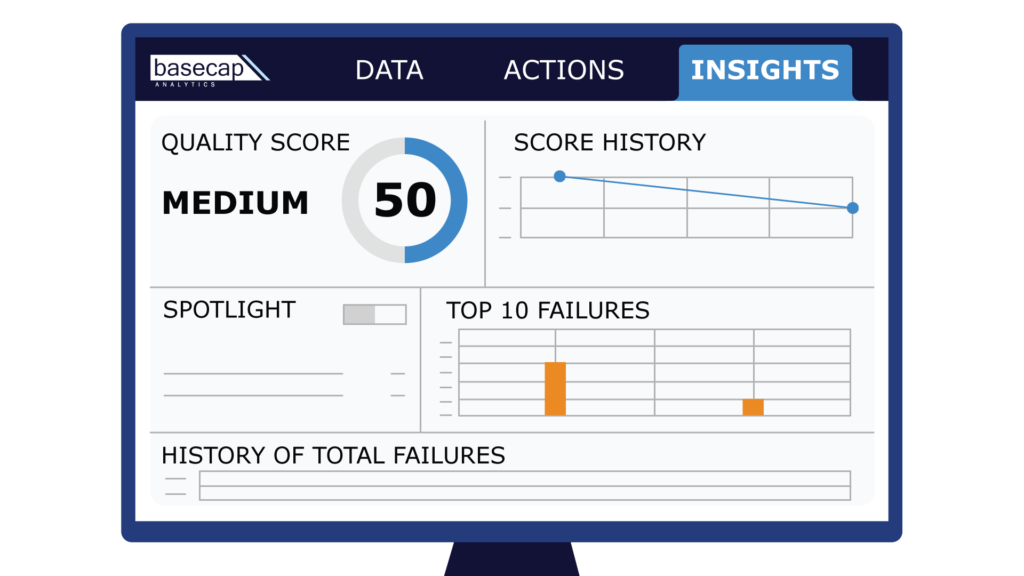

With endless PDFs, spreadsheets, and documents running through your systems, it’s all too easy for bad data to proliferate. BaseCap embeds advanced process automation into your most important workflows to eliminate opportunities for error, bottlenecks, and inactivity.

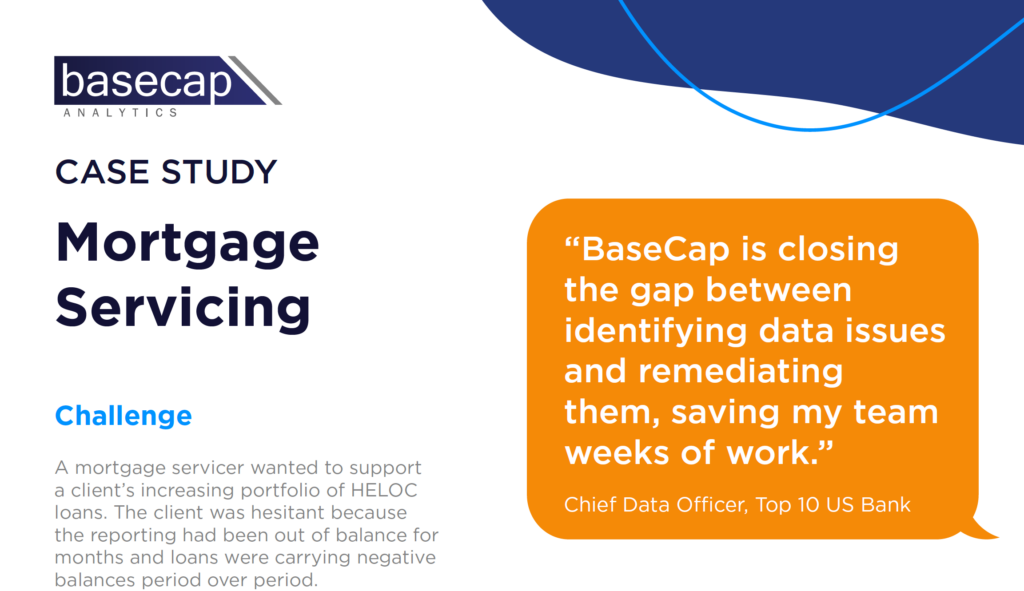

Take it from our clients.

Find out how one mortgage servicer improved their reporting and increased their portfolio using the BaseCap Platform.

How would automating your data validation processes impact your org?

Save your teams time and relieve the frustration of manual data reviews so they can focus on solving problems and adding value. “BaseCap isn’t here to write your reports for you. We’re here so you never have to run another report again.”

~ Virginia Earley, Senior Account Executive

Ready to see BaseCap in action?

Meet with one of our data quality experts to discover how our platform can address your data challenges.