Room for Improvement

Mortgage processing has tremendous opportunity for improvement. 2020 was a banner year for mortgage businesses as the historically low-rate environment drove a record volume of loan applications. However, while mortgage companies saw an increase in volume and per-loan revenue, per-loan expense also grew.

Historically, production expenses drop when volume increases, but per-loan production expenses went up in 2020, as companies offered signing bonuses, incentives, overtime, and other compensation to address capacity constraints and meet mortgage demand.

This demonstrates that mortgage businesses have room to improve on their loan processes in terms of efficiency and responsiveness. The combination of Robotic Process Automation (RPA) and Intelligent Automation (IA) addresses this gap and was one of the “Seven Major Mortgage Servicing Tech Trends” reported by DSNews in 2020.

Below is an overview of these two technological approaches, how they are being used in mortgage servicing, and tips on how they can be implemented effectively.

Robotic Process Automation (RPA) and Intelligent Automation (IA)

As the Venn diagram above shows, IA is RPA with AI/ML integration. These are not competing technologies, but complementary approaches to automation.

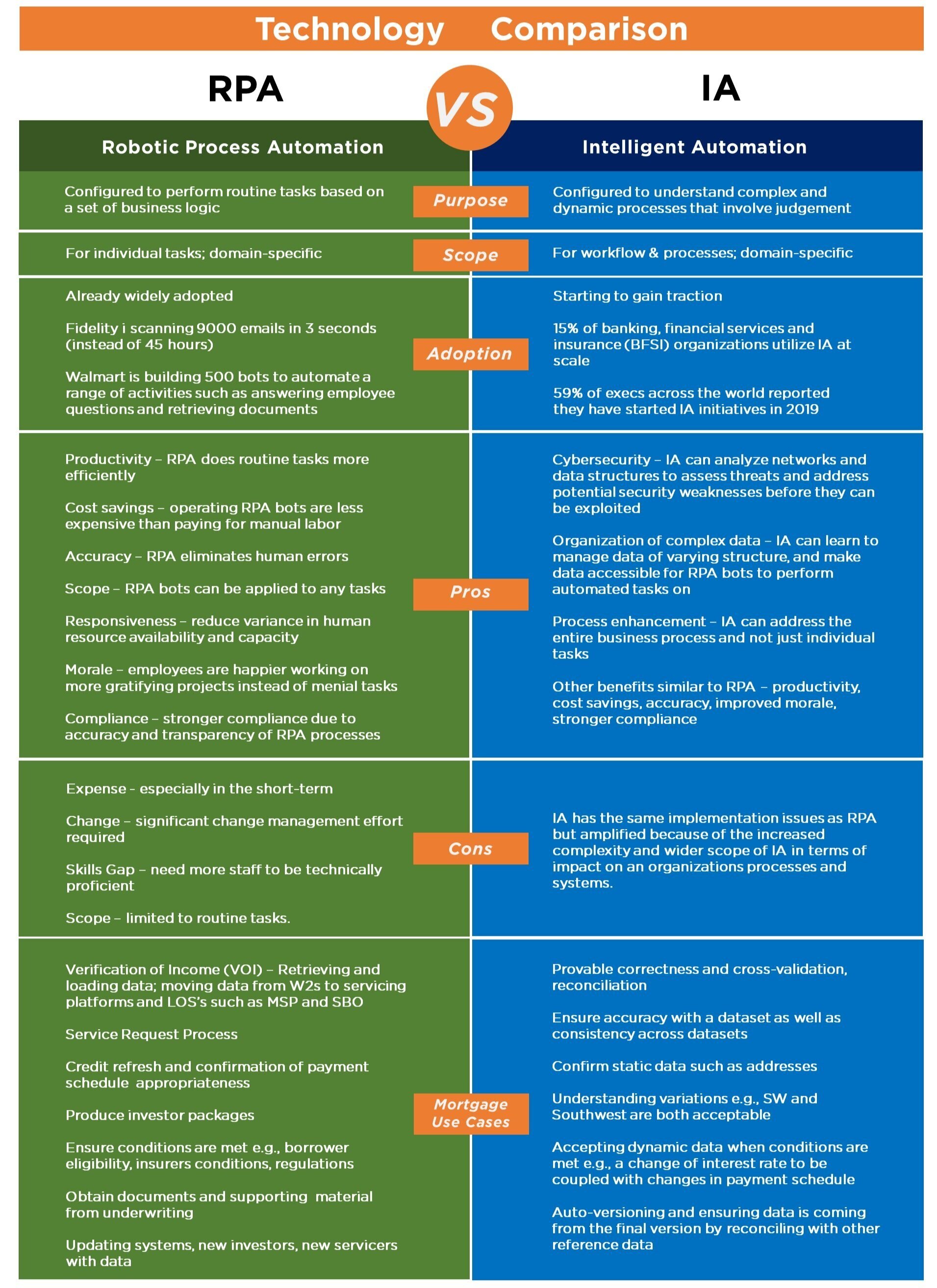

The following chart compares the purpose, scope, adoption, as well as the pros and cons of implementing Robotic Process Automation and Intelligent Automation technologies along with some use case examples in the mortgage space.

Implementation Tips

Digital transformation can be difficult but is critical in this data-driven business environment. RPA and IA are process automation initiatives and will require significant planning and organization-wide involvement in implementation.

-

Dual Implementation – according to Harvard Business Review, combining RPA and artificial intelligence (AI), leading to an average increase in revenue of 9% as opposed to 3% in those that do not combine the technologies.

-

Sequence – RPA is simpler and can be deployed for individual tasks. Deploy for tasks that are mature and not changing daily. “Stable are good candidates for automation”. (AI Multiple)

-

Scale after buy-in – While it is ideal to implement RPA and IA together, it makes sense to introduce RPA in a pilot program. You will need champions for this initiative because it will be a concerted effort to ensure effective implementation.

-

-

Involve all stakeholders – You should not rely on IT to figure everything out. You will have to create a taskforce comprising of various roles that will be impacted by automation.

-

Invest in training – education and training are critical to the success of implementation of any new technology.

Putting together RPA and IA – a Human Analogy

RPA is like our autonomous nervous system, which keeps us alive by automatically performing critical tasks such as regulating various hormone levels, and activating fight or flight responses, or creating senses like hunger.

Then, there is decision process on what to eat. IA is analogous to creating a refined system of deciding on what and when to eat based on factors such as convenience, perceived nutritional value, anticipated activities later in the day, price, novelty, etc. When joining a new company, this decision might take a while. But after working at a specific company for a while, this decision process becomes fluid. This is akin to the AI/ML improving the IA functionality over time.

The human analogy illustrates the complementary nature of RPA and IA. RPAs should be implemented for mundane routine tasks but needs to be paired with IA to automate entire processes. This is a heavy lift and will require significant upfront costs for technology and training. But, in the long run, your processes will be much more efficient, reliable, and responsive to rapid market changes and opportunities like what we have seen in recent years.

BaseCap Analytics helps businesses improve data quality

BaseCap Analytics help organizations clean the data they rely on so they can be confident in using their data to drive business decisions, demonstrate regulatory compliance, provide seamless customer experience, etc.

Data quality will be critical to implementation of technologies like RPA and IA. As noted above, “provable correctness and cross-validation/reconciliation” is a foundation for automating the loan process.

Contact us and let our team of data experts help you modernize your loan process, starting with making sure your data is clean and designing your mortgage data pipeline and workflow to leverage technologies like RPA and IA.