Use Case

Enterprise Insight

Even the most valuable data points mean nothing if you can’t trust them. Can you be confident that all of your files and figures have been 100% vetted?

Better data, better insight, better outcomes

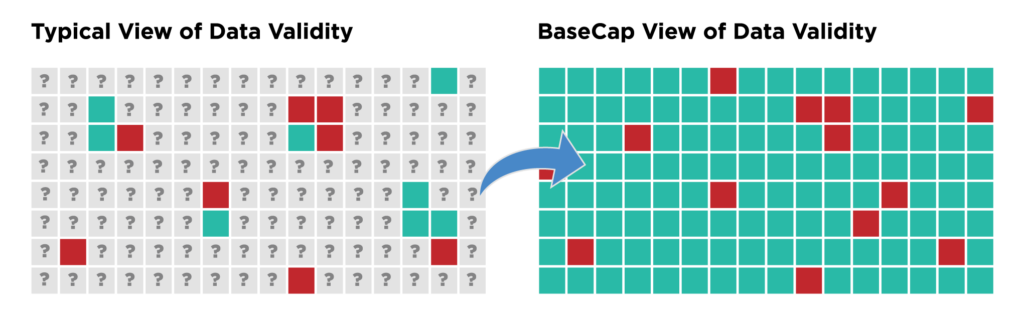

You don’t know what you don’t know. BaseCap is the data health tracker that illuminates all of your information for better analysis and decision-making.

Are you facing these challenges?

Department heads rely on each other's data, but they can never be sure of its quality. Access controls, system variation, siloes, even vocabulary can all turn your analytics into a game of telephone. If you're exhausted by these common challenges, consider BaseCap's break-through solution.

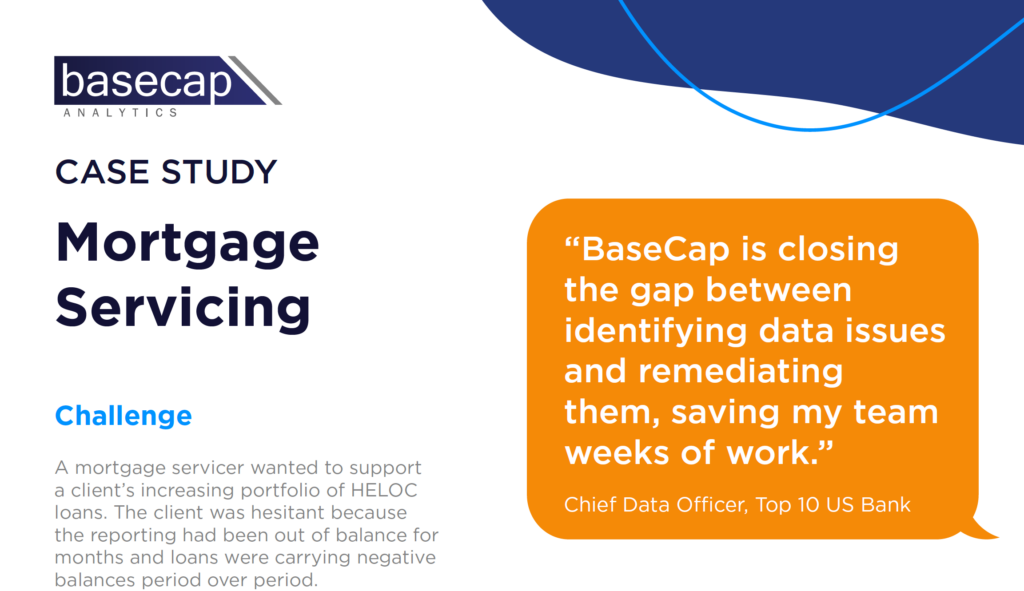

Take it from our clients.

Find out how one mortgage servicer improved their reporting and increased their portfolio using the BaseCap Platform.

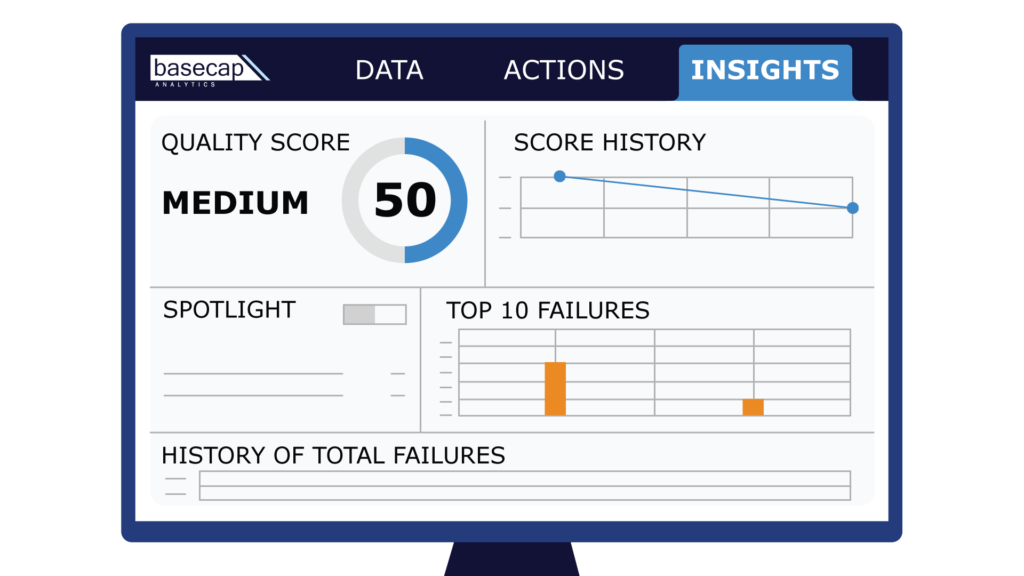

Insight you can actually trust

Stop tracking down the original source of data to validate the information you rely on. By vetting your data through BaseCap, you never have to worry about units, formats, or absent data corrupting your analysis. “It’s like a funnel bringing all of your data into one place. With a unified view of 100% validated data, executives can feel more confident in their most important decisions.”

~ Craig Riddell, Executive Director of Sales and Account Management

Ready to see BaseCap in action?

Meet with one of our data quality experts to discover how our platform can address your data challenges.