New regulatory rules are having a big impact on community banks, particularly those who have not made compliance a priority, according to figures released in the most recent Banking Compliance Index.

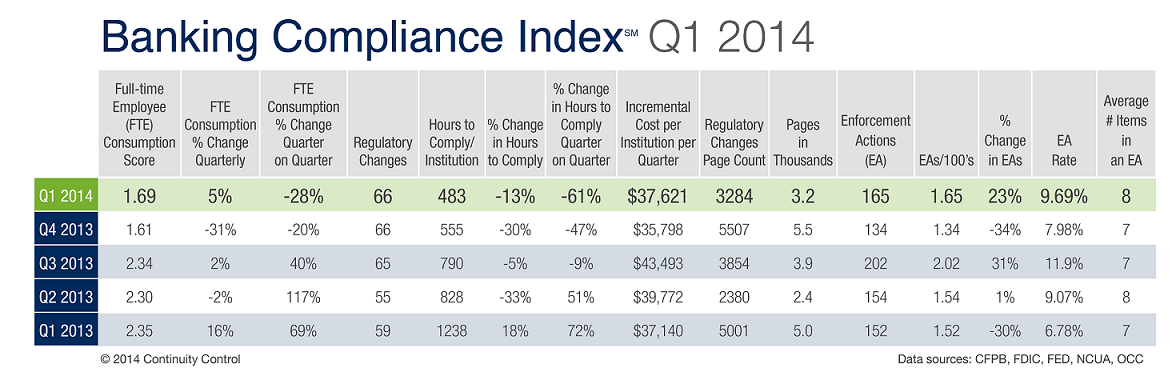

Financial institutions were subject to 66 new regulatory items in the first quarter of 2014. The latest index shows enforcement actions against community financial institutions increased nearly 25 percent in the first quarter of 2014 over last quarter.

“It’s no longer enough for bankers to simply know how to stay compliant; they’ve got to prove that there’s an effective, robust system in place,” said Pam Perdue, a former federal examiner and the current executive vice president, regulatory insight, at Continuity Control, the compliance management systems provider that compiles and analyzes the index.

A total of 165 enforcement actions were issued during this time, according to the quarterly index. The average community bank needed the equivalent of 1.69 extra full-time employees as well as an additional $37,621 in spending to cope with this extra load.

Many of the enforcement actions in the first quarter involved issues of safety and soundness, which Continuity Control asserts is a signal that regulators are now focusing more on the overall compliance management processes in place at community banks.

“In 2014, with a focus shift to Basel III, there will be much attention placed on capital frameworks, which means the people on the fiscal side of the house are going to have a busy year,” said Perdue.

Perdue added, since more complex regulations are being issued at a high rate, qualified personnel are more difficult to retain, particularly in non-urban areas. Community banks are at a disadvantage in finding experienced compliance officers who now expect higher salaries for the higher workload.

“Large banks have the capacity and resources to handle these challenges efficiently, but smaller institutions continue to feel the heat of the current regulatory environment,” said Perdue.

Compared to the same quarter in 2013 when there was a record amount of regulatory increases, the growth of regulatory burden slowed slightly in the first quarter of 2014.

The index is calculated using a multivariate analysis that can be weighted across different contexts and is calibrated to determine the regulatory impact on financial institutions of varying sizes, product mixes, and regulatory oversight. It uses key indicators including volume, velocity and complexity of regulatory change; time expended to meet regulatory requirements; as well as supervision and the enforcement climate.

The results of the index below show how crucial it has become for banks to place more focus on compliance processes in order to avoid costly enforcement actions.