Use Case

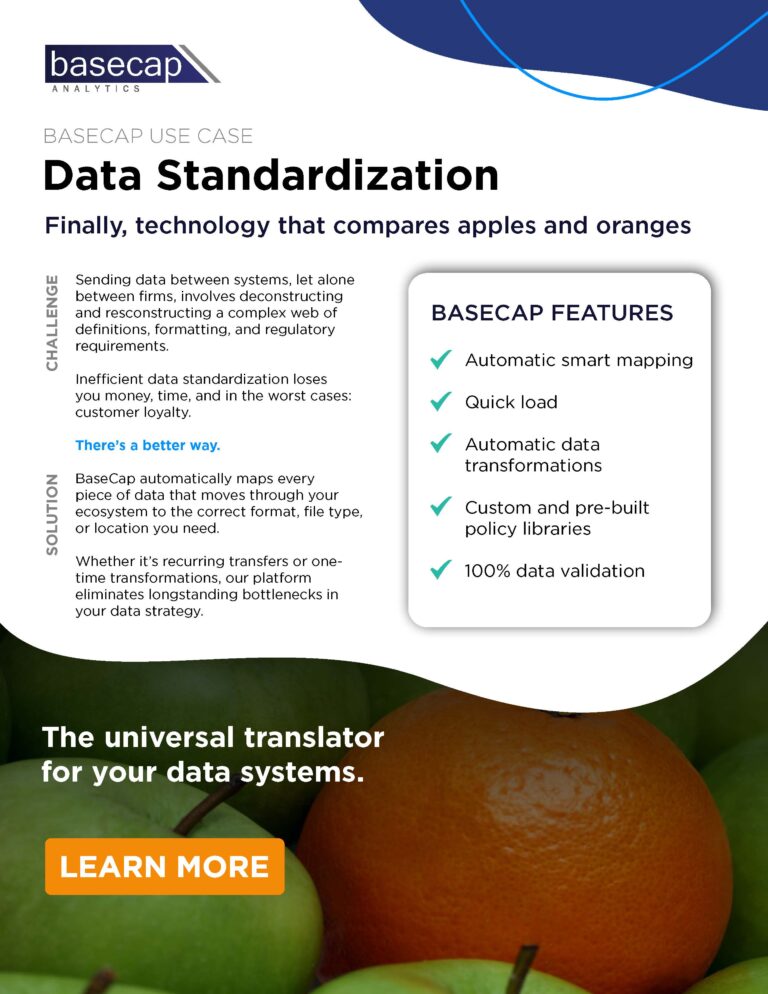

Data Standardization

Without seamless comparison, simple data transformations like changing date formats from MM/DD/YYYY to DD/MM/YY can bring your most important processes to a screeching halt.

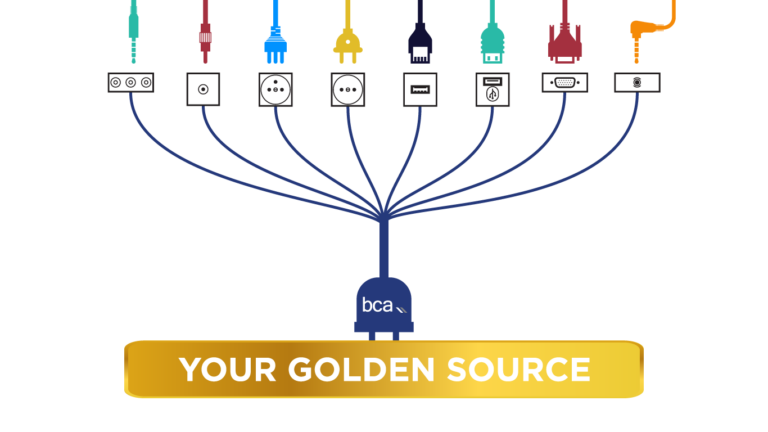

Plug-and-play Data Standardization with BaseCap

What if all of the data that plugs into your information ecosystem got automatically standardized and mapped to other systems and data sources? BaseCap is like a universal outlet for all of your most important data sources, enabling your teams to work from one golden source of truth.

Are you facing these challenges?

Any company working in Excel spreadsheets and SQL databases knows how difficult keeping up with divergent definitions and file formats can be. Moreover, the use of data is constantly in flux; regulations change as quickly as they are created. Add in business transactions where data is boarded or delivered to a third party and the whole web becomes indecipherable. BaseCap marries all your data, automatically comparing apples to oranges so you can get to the insight part faster.

Take it from our clients.

Explore how one mortgage servicer supported an increasing portfolio of HELOC loans with BaseCap data standardization.

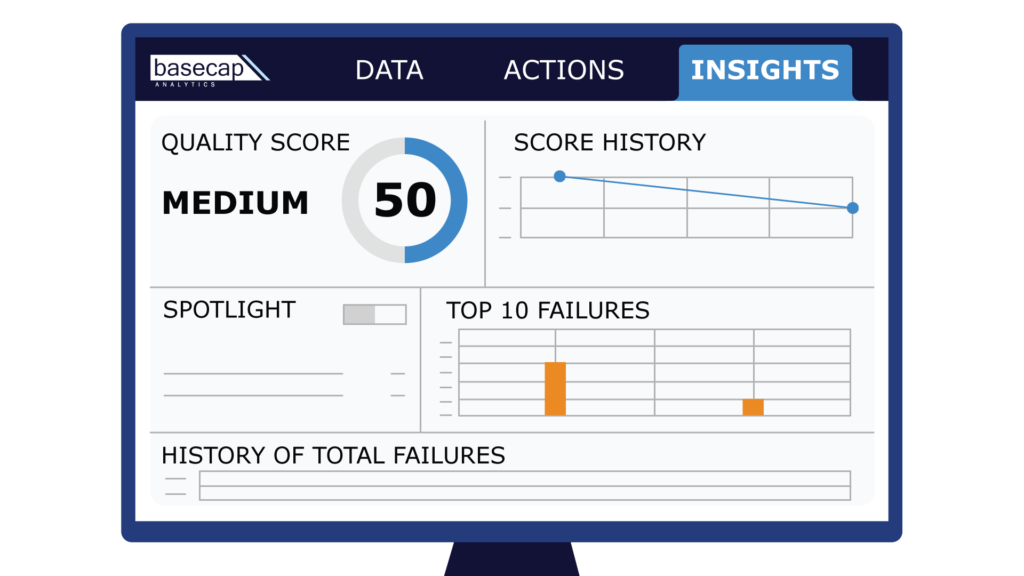

How can BaseCap solve your data standardization challenges?

Take the headache out of data prep. Actually, take the prep out of data prep. BaseCap gets your information ready for analysis automatically, so that your teams work from the same golden source. “The ability to seamlessly tie together another’s data with your own in moments instead of months changes the face of servicing transfer, securitizations, even GL feeds and bank account reconciliations. This would have saved years of tedious mapping throughout my career.”

~ Jason Ahl, Head of Mortgage Solutions

Ready to see BaseCap in action?

Meet with one of our data quality experts to discover how our platform can address your data challenges.