Customer Stories

UCC Deadline Tracking

Automated quality assurance

Faster Reviews

Rapid comparison of loans to Lument’s system of record

Employees Unlocked

QA team freed up to investigate nuanced loan defects

Greater Volume

More loan files checked every week

SCENARIO

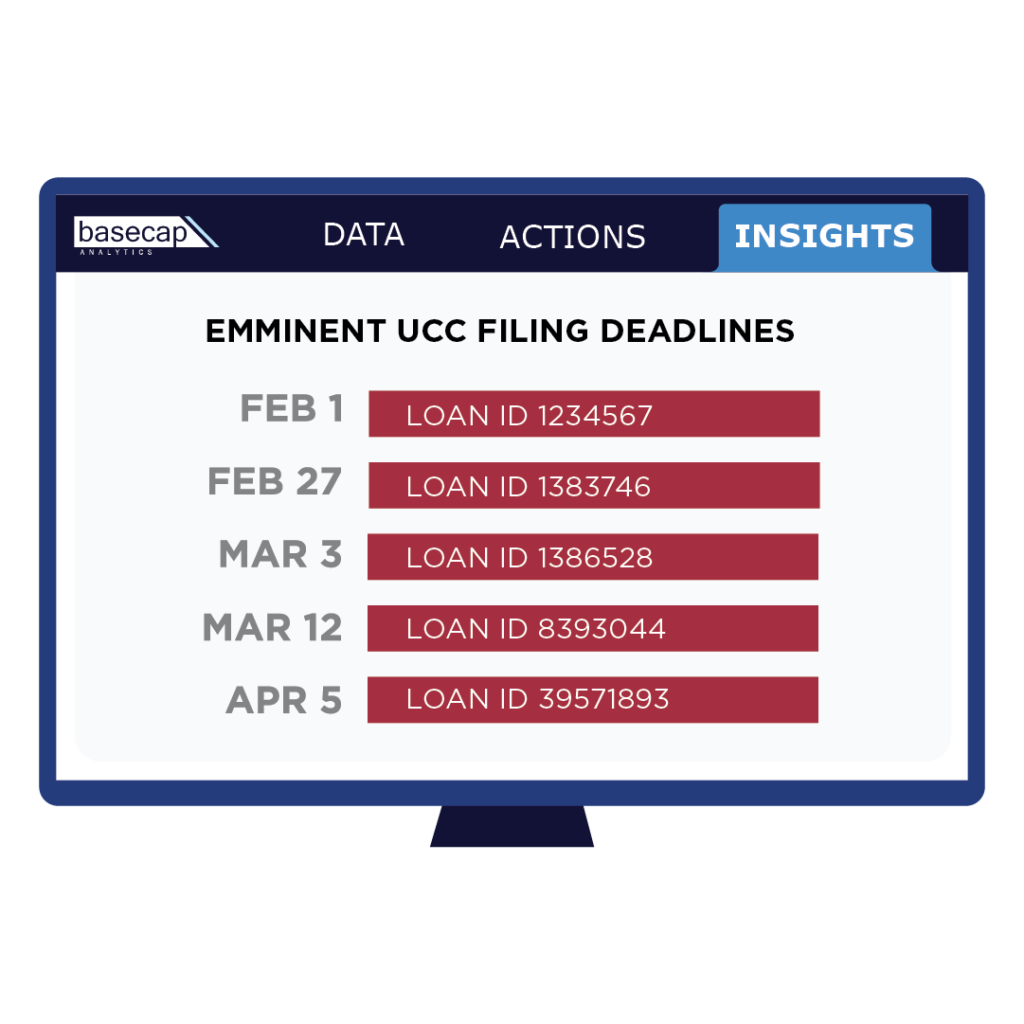

The Quality Assurance team at Lument, a prominent mortgage lender, spent hours of manual analysis tracking UCC deadlines in their loan portfolio. If the deadline to renew wasn’t met, the business could be damaged by financial losses and loss of priority position. With BaseCap deployed, the team leader leveraged the extra time to focus his analysts on tasks that required more nuance and advanced problem-solving.

CHALLENGE

Before engaging BaseCap, Lument manually processed large batches of JSON, XML, XLSX, and PDFs on a weekly basis. Tracking UCC deadlines within these files was laborious and error-prone, leading to false positives.

SOLUTION

The customer leveraged BaseCap’s automated data validation platform for the following use cases:

- Automated comparison of loan files to the system of record

- Simplified data interpretation and column mapping

- Self-serve policy creation to target specific questions about their data

RESULTS

These solutions created tangible benefits for the organization, including:

- Faster loan reviews

- Greater capacity to investigate nuanced loan defects

- Right-sized quality assurance budget

- Enhanced reporting capabilities

- More reliable quality control metrics

No more stare-and-compares

BaseCap helps you validate data with greater speed and accuracy. Speak to an account executive to learn more.