Use Case

Checklist Automation

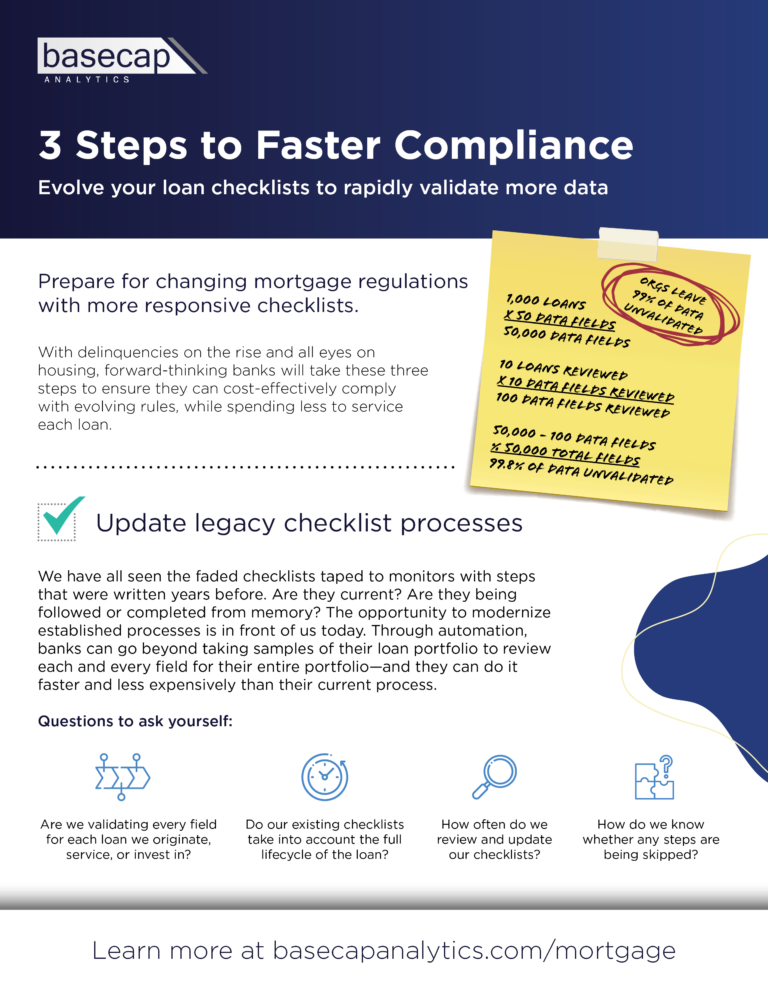

Enterprises using manual checklists to review and report on regulatory compliance can save thousands of hours with automation.

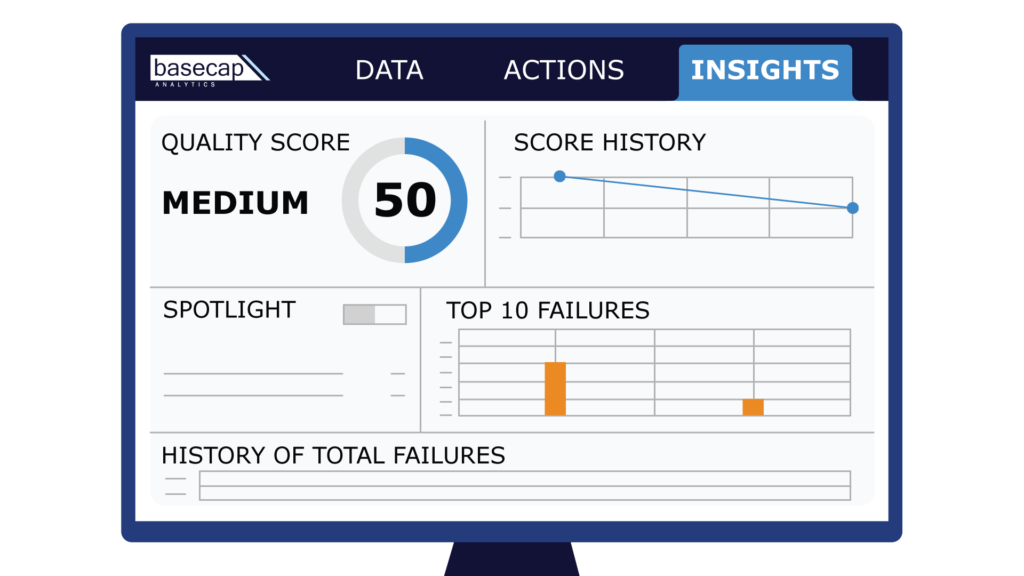

Speed up compliance and risk management processes

How quickly can your organization audit your data and adapt to new regulations? Download our report to learn how to modernize your compliance workflows.

“The cost of gaps in compliance processes includes avoidable errors, reputational damage, and incomplete validation. These risks expose your organization to fines, costly corrections, and expensive operations.”

Trusted Mortgage Tech

HousingWire recognized BaseCap Analytics as a Mortgage Tech100 Honoree.

Facing these challenges?

Every loan servicer on the floor of your office checks off hundreds of boxes a week. Often, these baked-in processes are key to validating regulatory compliance or understanding the value of your loan portfolio. Seasoned lending professionals run through these checklists by memory, all while staring and comparing loan data for hours into the night. There’s a better way.

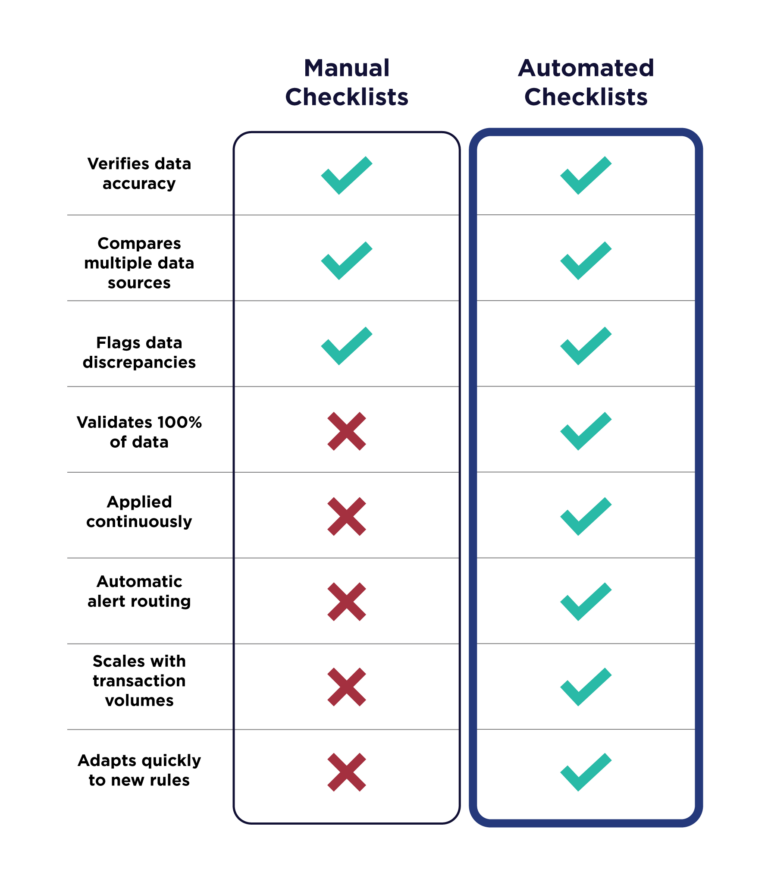

How does BaseCap compare?

We’ll put up our streamlined solution against traditional checklist processes any day.

Ready to see BaseCap in action?

Meet with one of our data quality experts to discover how our platform can address your data challenges.