Turn

into actionable insight

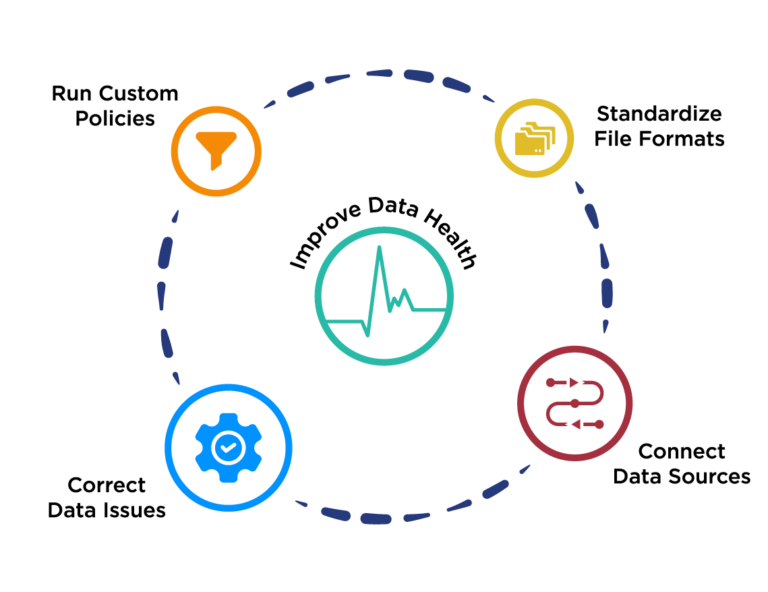

BaseCap is the data health tracker that helps you diagnose and solve business challenges

Data health is Business health

Enterprises turn to BaseCap to prevent bad data from corrupting their most important operations.

Not sure where your data challenges lie? Take the pulse of your business with BaseCap.

Take preventative action against bad data

Most companies don’t know they have data issues until complaints pour in, audit findings stack up, and processes slow down. Instead, run BaseCap continuously across all of your data to proactively combat bad data in your information ecosystem.

What kind of 'data' are we talking about?

Your business doesn’t run on ones and zeros; it runs on PDFs and spreadsheets, signatures and date stamps, client records, and financial reports. BaseCap lets all of these files talk to each other, vetting and filtering them to help you gain insight faster.

Who uses BaseCap?

Decision-makers in every industry can use BaseCap to automate processes and answer questions about their data.

Don’t see your industry? We can still help you fight bad data. Request a demo to learn how.

TRUSTED BY INNOVATIVE COMPANIES WORLDWIDE

“BaseCap’s solutions improve our processes and make it easy to scale to the surges in the market as they happen without changing staffing.”

Carol Norton, SVP, Servicing Systems, New American Funding

“A huge thank you for delivering what BaseCap promised. This does what was promised…that’s a rare thing.”

SVP, Transaction Management, Leading Global Investment Company