Customer Stories

Post-Boarding Loan QC

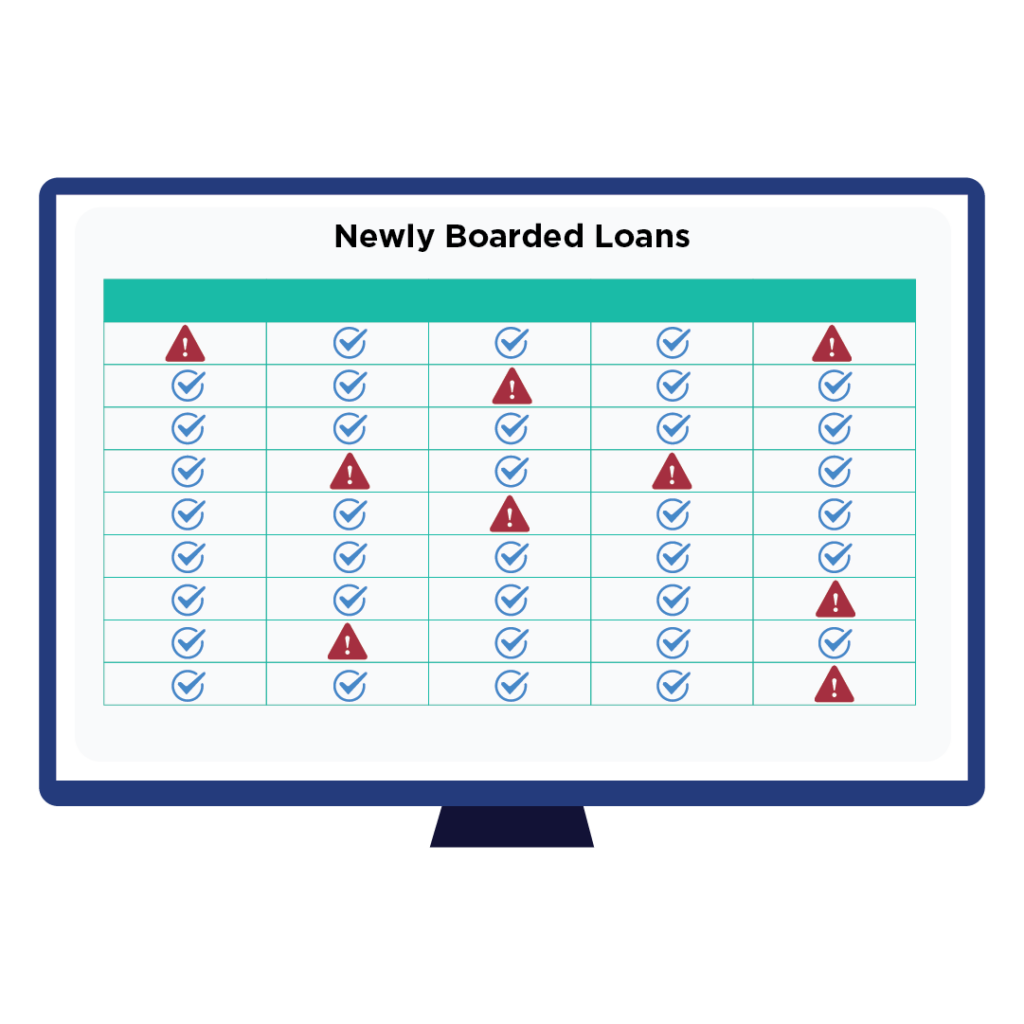

Rapidly comparing new loan data to a system of record.

73%

of loans confirmed accurate with no human touch

13 FTEs

became available due to efficiency gains from BaseCap reviews

$74

savings per loan for data reviews

SCENARIO

New American Funding faced difficulties comparing data from new loans to their system of record. The onboarding team struggled to validate loans within 5 days, at which point the org must send a “Welcome Letter” to the borrower.

CHALLENGE

Before engaging BaseCap, New American Funding funneled precious resources into a manual “stare-and-compare” loan data validation process. With their onboarding team checking thousands of data fields every day, the resource strain created risk for the organization.

SOLUTION

The customer leveraged BaseCap’s automated data validation platform for the following use cases:

- Document extraction, validation, and conversion into a database table

- Automated comparison of document data to the system of record

RESULTS

These solutions created tangible benefits for the organization, including:

- Efficiency gain of 81% by reducing the number of employees required for data validation

- Enhanced focus on critical errors

- Validation of 73% of loans without human touch

No more stare-and-compares

BaseCap helps you validate data with greater speed and accuracy. Speak to an account executive to learn more.